Question: works. Let's look at the harmonized code from Schedule B of: 0303.12.0012. 03 refers to the chapter in which the commodity is classified, Fish. 0302

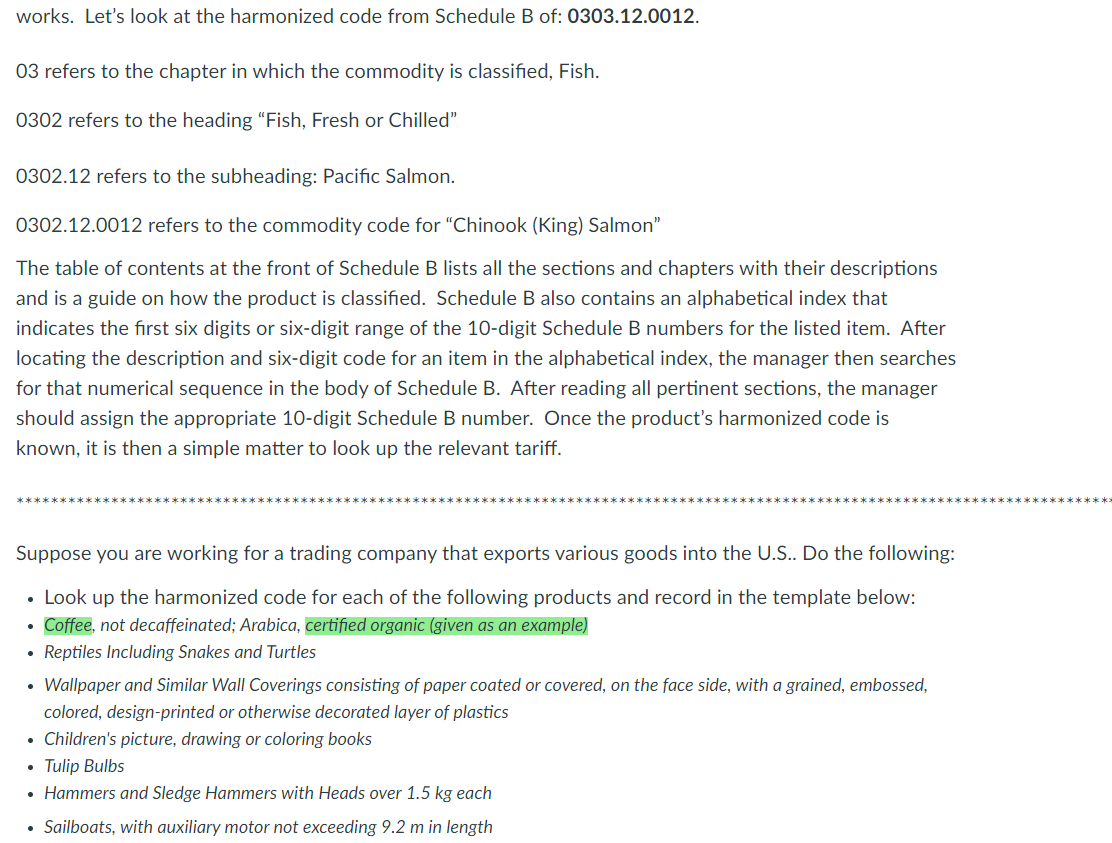

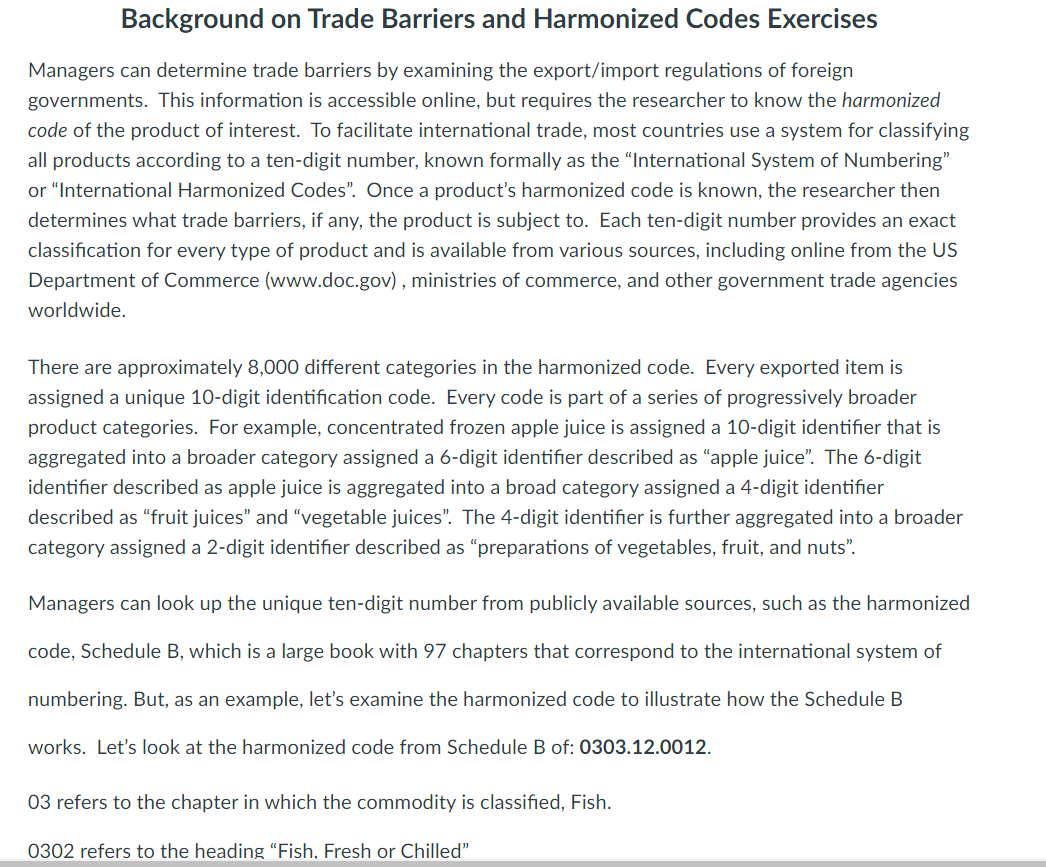

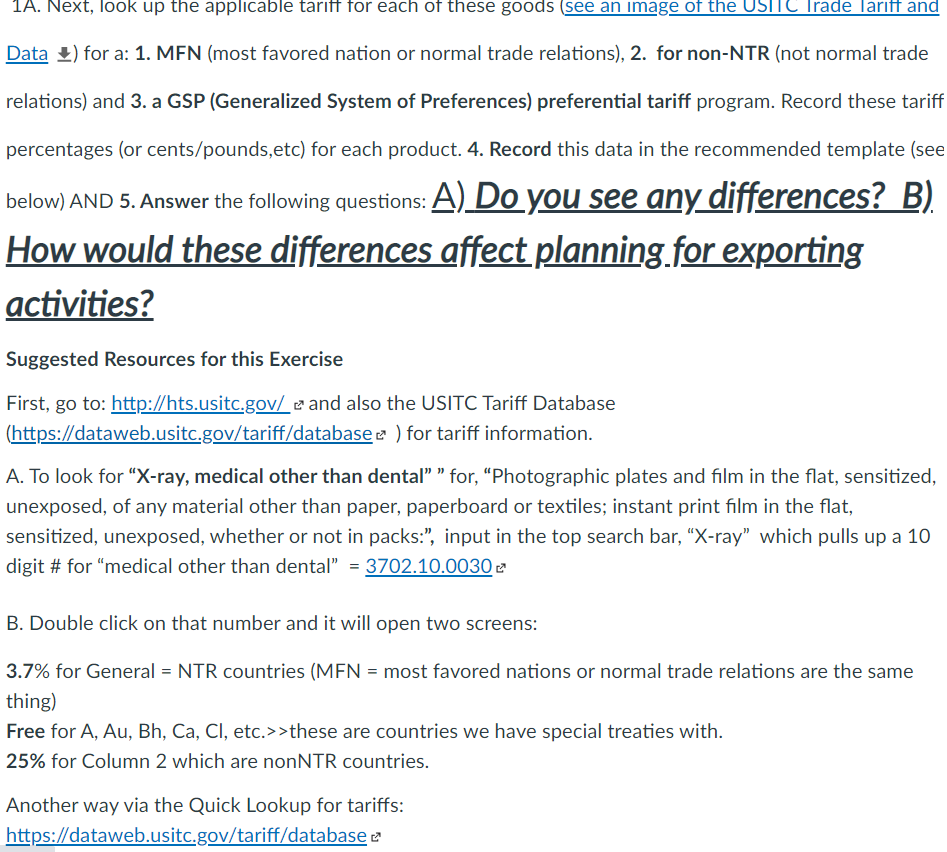

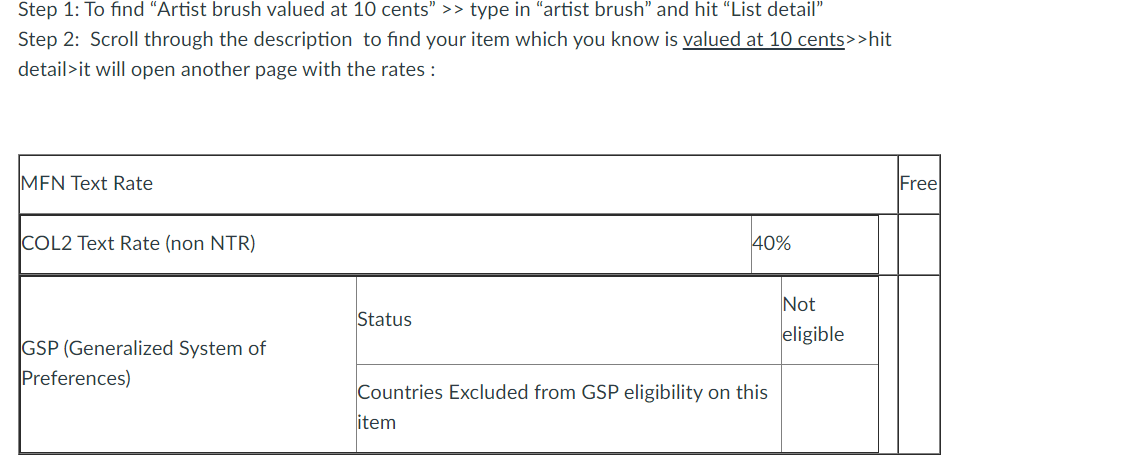

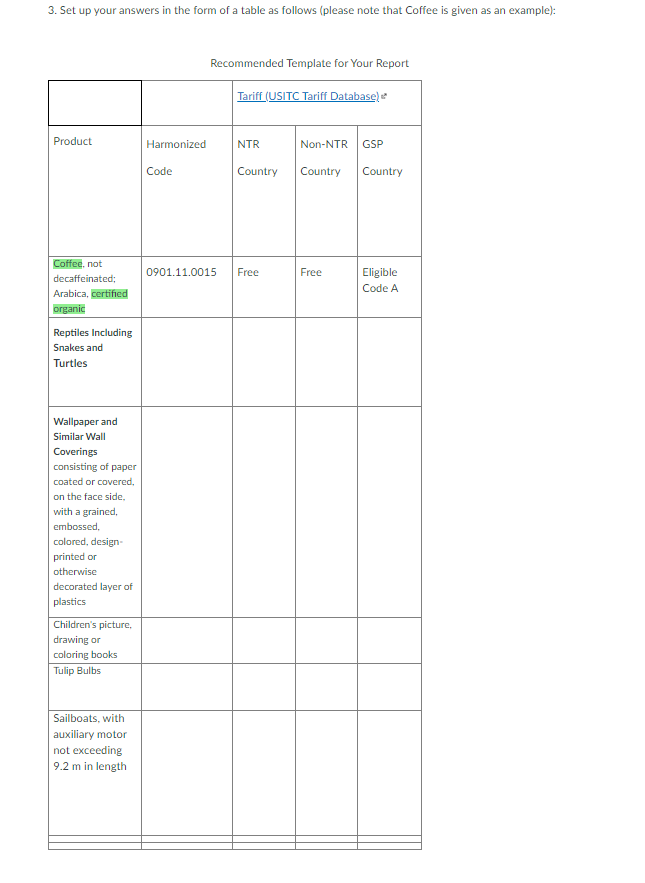

works. Let's look at the harmonized code from Schedule B of: 0303.12.0012. 03 refers to the chapter in which the commodity is classified, Fish. 0302 refers to the heading "Fish, Fresh or Chilled" 0302.12 refers to the subheading: Pacific Salmon. 0302.12.0012 refers to the commodity code for "Chinook (King) Salmon" The table of contents at the front of Schedule B lists all the sections and chapters with their descriptions and is a guide on how the product is classified. Schedule B also contains an alphabetical index that indicates the first six digits or six-digit range of the 10-digit Schedule B numbers for the listed item. After locating the description and six-digit code for an item in the alphabetical index, the manager then searches for that numerical sequence in the body of Schedule B. After reading all pertinent sections, the manager should assign the appropriate 10-digit Schedule B number. Once the product's harmonized code is known, it is then a simple matter to look up the relevant tariff. * *** **** * Suppose you are working for a trading company that exports various goods into the U.S.. Do the following: . Look up the harmonized code for each of the following products and record in the template below: . Coffee, not decaffeinated; Arabica, certified organic (given as an example) . Reptiles Including Snakes and Turtles . Wallpaper and Similar Wall Coverings consisting of paper coated or covered, on the face side, with a grained, embossed, colored, design-printed or otherwise decorated layer of plastics . Children's picture, drawing or coloring books . Tulip Bulbs . Hammers and Sledge Hammers with Heads over 1.5 kg each . Sailboats, with auxiliary motor not exceeding 9.2 m in lengthBackground on Trade Barriers and Harmonized Codes Exercises Managers can determine trade barriers by examining the export/import regulations of foreign governments. This information is accessible online, but requires the researcher to know the harmonized code of the product of interest. To facilitate international trade, most countries use a system for classifying all products according to a ten-digit number, known formally as the "International System of Numbering" or "International Harmonized Codes". Once a product's harmonized code is known, the researcher then determines what trade barriers, if any, the product is subject to. Each ten-digit number provides an exact classification for every type of product and is available from various sources, including online from the US Department of Commerce (www.doc.gov) , ministries of commerce, and other government trade agencies worldwide. There are approximately 8,000 different categories in the harmonized code. Every exported item is assigned a unique 10-digit identification code. Every code is part of a series of progressively broader product categories. For example, concentrated frozen apple juice is assigned a 10-digit identifier that is aggregated into a broader category assigned a 6-digit identifier described as "apple juice". The 6-digit identifier described as apple juice is aggregated into a broad category assigned a 4-digit identifier described as "fruit juices" and "vegetable juices". The 4-digit identifier is further aggregated into a broader category assigned a 2-digit identifier described as "preparations of vegetables, fruit, and nuts". Managers can look up the unique ten-digit number from publicly available sources, such as the harmonized code, Schedule B, which is a large book with 97 chapters that correspond to the international system of numbering. But, as an example, let's examine the harmonized code to illustrate how the Schedule B works. Let's look at the harmonized code from Schedule B of: 0303.12.0012. 03 refers to the chapter in which the commodity is classified, Fish. 0302 refers to the heading "Fish. Fresh or Chilled"1A. Next, look up the applicable tariff for each of these goods (see an image of the USIC Trade Tariff and Data ) for a: 1. MFN (most favored nation or normal trade relations), 2. for non-NTR (not normal trade relations) and 3. a GSP (Generalized System of Preferences) preferential tariff program. Record these tariff percentages (or cents/pounds,etc) for each product. 4. Record this data in the recommended template (see below) AND 5. Answer the following questions: A)_Do you see any differences? B). How would these differences affect planning for exporting activities? Suggested Resources for this Exercise First, go to: http://hts.usitc.gov/_ and also the USITC Tariff Database (https://dataweb.usitc.gov/tariff/database= ) for tariff information. A. To look for "X-ray, medical other than dental" " for, "Photographic plates and film in the flat, sensitized, unexposed, of any material other than paper, paperboard or textiles; instant print film in the flat, sensitized, unexposed, whether or not in packs:", input in the top search bar, "X-ray" which pulls up a 10 digit # for "medical other than dental" = 3702.10.0030 B. Double click on that number and it will open two screens: 3.7% for General = NTR countries (MFN = most favored nations or normal trade relations are the same thing) Free for A, Au, Bh, Ca, Cl, etc.> >these are countries we have special treaties with. 25% for Column 2 which are nonNTR countries. Another way via the Quick Lookup for tariffs: https://dataweb.usitc.gov/tariff/databaseStep 1: To find "Artist brush valued at 10 cents" > > type in "artist brush" and hit "List detail" Step 2: Scroll through the description to find your item which you know is valued at 10 cents> >hit detail>it will open another page with the rates : MFN Text Rate Free COL2 Text Rate (non NTR) 40% Status Not GSP (Generalized System of eligible Preferences) Countries Excluded from GSP eligibility on this item3. Set up your answers in the form of a table as follows (please note that Coffee is given as an example): Recommended Template for Your Report Tariff (USITC Tariff Database) Product Harmonized NTR Non-NTR GSP Code Country Country Country Coffee, not decaffeinated; 0901.11.0015 Free Free Eligible Arabica, certified Code A organic Reptiles Including Snakes and Turtles Wallpaper and Similar Wall Coverings consisting of paper coated or covered, on the face side. with a grained, embossed, colored, design- printed or otherwise decorated layer of plastics Children's picture, drawing or coloring books Tulip Bulbs Sailboats, with auxiliary motor not exceeding 9.2 m in length

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts