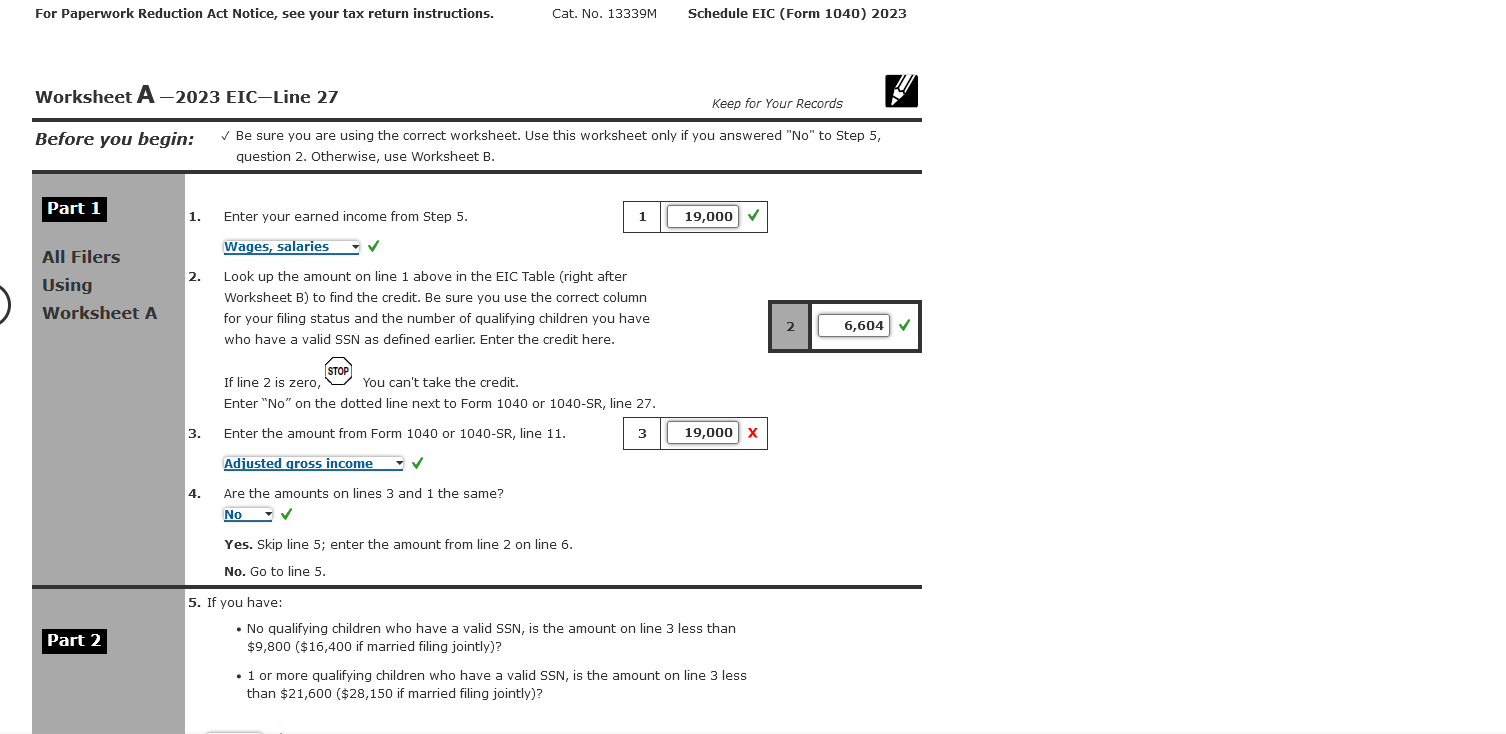

Question: Worksheet A - 2 0 2 3 EIC - Line 2 7 Before you begin: ( quad checkmark ) Be sure

Worksheet A EICLine

Before you begin: quad checkmark Be sure you are using the correct worksheet. Use this worksheet only if you answered No to Step question Otherwise, use Worksheet B

If line is zero,

You can't take the credit.

Enter No on the dotted line next to Form or SR line

Enter the amount from Form or SR line

Are the amounts on lines and the same?

Yes. Skip line ; enter the amount from line on line

No Go to line

If you have:

No qualifying children who have a valid SSN is the amount on line less than $ $ if married filing jointly

or more qualifying children who have a valid SSN is the amount on line less than $ $ if married filing jointly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock