Question: Worksheet Adjustments for Selected Accounts) Presented here is a partial list of accounts for the total governmental funds of the City of Bukowy. What worksheet

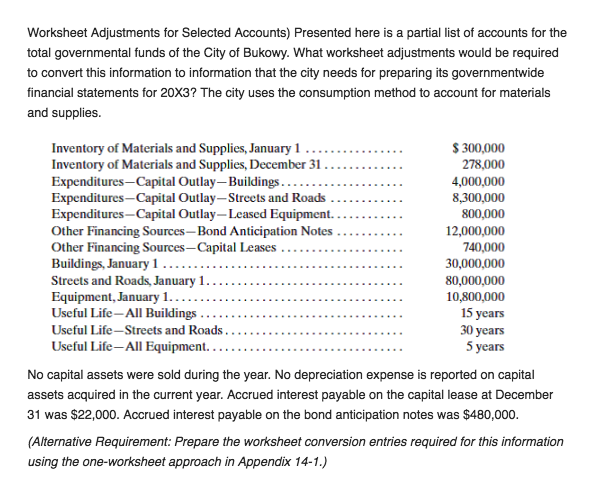

Worksheet Adjustments for Selected Accounts) Presented here is a partial list of accounts for the total governmental funds of the City of Bukowy. What worksheet adjustments would be required to convert this information to information that the city needs for preparing its governmentwide financial statements for 20X3? The city uses the consumption method to account for materials and supplies. 300,000 278,000 4,000,000 8,300,000 800,000 12,000,000 740,000 30,000,000 80,000,000 10,800,000 15 years 30 years 5 years Inventory of Materials and Supplies, January 1 Inventory of Materials and Supplies, December 31...... Expenditures Expenditures-Capital Outlay-Streets and Roads Other Financing Sources-Bond Anticipation Notes Other Fina ncing Sources-Capital Leases . . No capital assets were sold during the year. No depreciation expense is reported on capital assets acquired in the current year. Accrued interest payable on the capital lease at December 31 was $22,000. Accrued interest payable on the bond anticipation notes was $480,000 (Alternative Requirement: Prepare the worksheet conversion entries required for this information using the one-worksheet approach in Appendix 14-1.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts