Question: WORKSHEET AND FINANCIAL STATEMENTS Entity A started operations on January 1, 20x1. A summary of the transactions during the year is provided below: 1. The

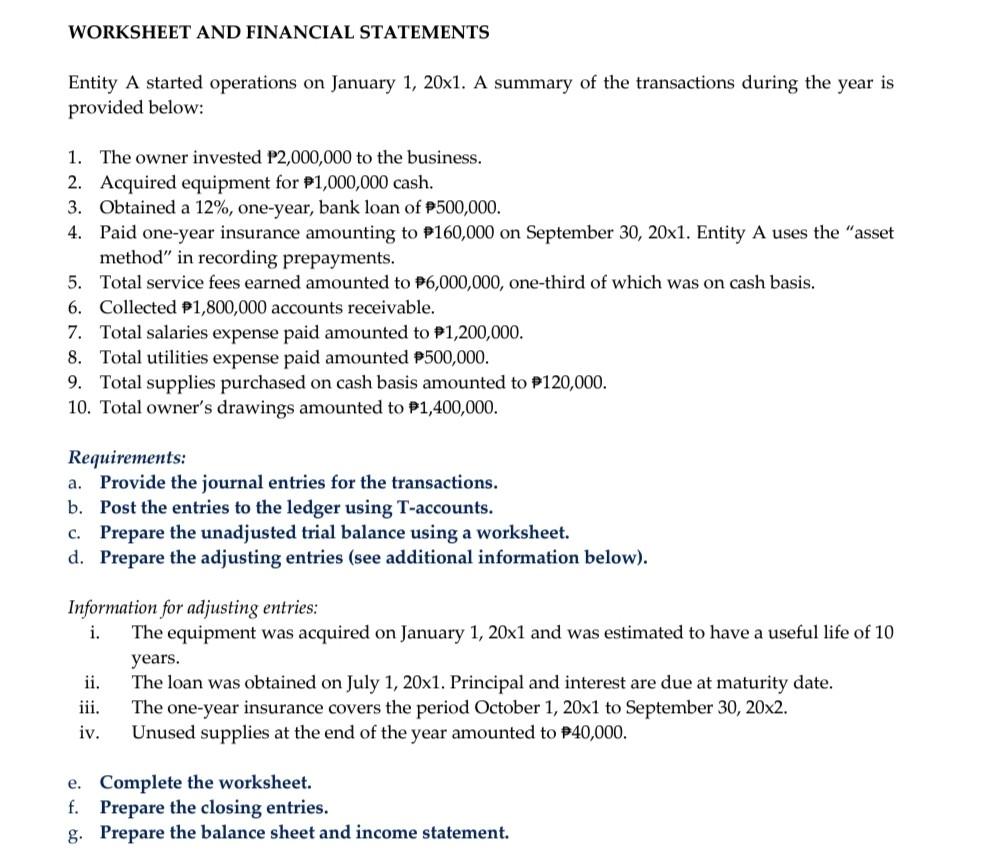

WORKSHEET AND FINANCIAL STATEMENTS Entity A started operations on January 1, 20x1. A summary of the transactions during the year is provided below: 1. The owner invested P2,000,000 to the business. 2. Acquired equipment for P1,000,000 cash. 3. Obtained a 12%, one-year, bank loan of $500,000. 4. Paid one-year insurance amounting to $160,000 on September 30, 20x1. Entity A uses the "asset method" in recording prepayments. 5. Total service fees earned amounted to #6,000,000, one-third of which was on cash basis. 6. Collected P1,800,000 accounts receivable. 7. Total salaries expense paid amounted to $1,200,000. 8. Total utilities expense paid amounted $500,000. 9. Total supplies purchased on cash basis amounted to $120,000. 10. Total owner's drawings amounted to $1,400,000. Requirements: a. Provide the journal entries for the transactions. b. Post the entries to the ledger using T-accounts. c. Prepare the unadjusted trial balance using a worksheet. d. Prepare the adjusting entries (see additional information below). Information for adjusting entries: i. The equipment was acquired on January 1, 20x1 and was estimated to have a useful life of 10 years. ii. The loan was obtained on July 1, 20x1. Principal and interest are due at maturity date. iii. The one-year insurance covers the period October 1, 20x1 to September 30, 20x2. Unused supplies at the end of the year amounted to $40,000. iv. e. Complete the worksheet. f. Prepare the closing entries. g. Prepare the balance sheet and income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts