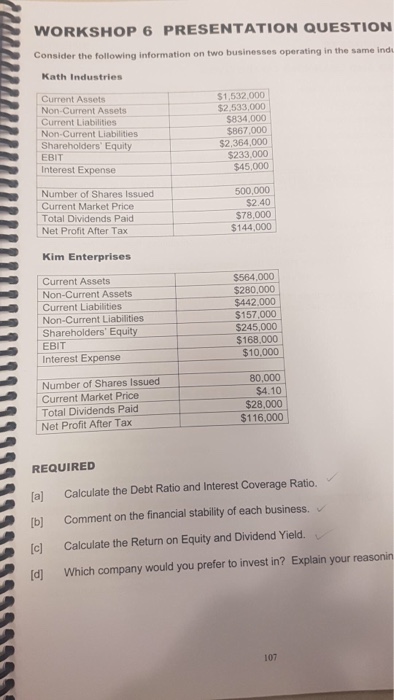

Question: WORKSHOP 6 PRESENTATION QUESTION Consider the following information on two businesses operating in the same Kath Industries Current Assets $1,532,000 $2,533,000 S834,000 $867,000 $2,364,000 $233,000

WORKSHOP 6 PRESENTATION QUESTION Consider the following information on two businesses operating in the same Kath Industries Current Assets $1,532,000 $2,533,000 S834,000 $867,000 $2,364,000 $233,000 $45,000 Non-Current Assets Current Liabilities Non-Current Liabilities Shareholders Equity EBIT Interest Expense Number of Shares Issued 500,000 $2.40 $78,000 $144,000 Current Market Price Total Dividends Paid Net Profit After Tax Kim Enterprises Current Assets Non-Current Assets $564,000 $280,000 $442.000 $157,000 $245,000 $168,000 $10,000 Current Liabilities Non-Current Liabilities Shareholders' Equity EBIT Interest Expense Interest E Number of Shares Issued Current Market Price Total Dividends Paid Net Profit After Tax 80,000 $4.10 $28,000 $116,000 REQUIRED a Calculate the Debt Ratio and Interest Coverage Ratio. b] Comment on the financial stability of each business. [c] Calculate the Return on Equity and Dividend Yield. d] Which company would you prefer to invest in? Explain your reasonin 107

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts