Question: Would Carter be better off if it issued fixed-rate debt or if it issued floating-rate debt and engaged in the swap? The swap is good

Would Carter be better off if it issued fixed-rate debt or if it issued floating-rate debt and engaged in the swap?

The swap is good for Carter, if it issued FLOATING RATE DEBT OR FLOATING DEBT RATE AND ENGAGED IN THE SWAP

Would Brence be better off if it issued floating-rate debt or if it issued fixed-rate debt and engaged in the swap?

The swap is good for Brence, if it issued FLOATING RATE DEBT OR FLOATING DEBT RATE AND ENGAGED IN THE SWAP

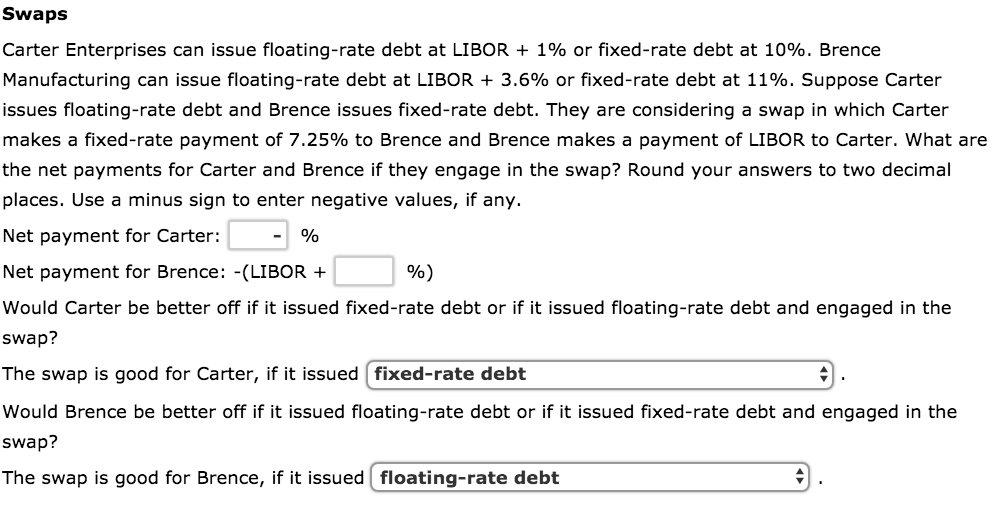

Swaps Carter Enterprises can issue floating-rate debt at LIBOR + 1% or fixed-rate debt at 10%. Brence Manufacturing can issue floating-rate debt at LIBOR + 3.6% or fixed-rate debt at 11%. Suppose Carter issues floating-rate debt and Brence issues fixed-rate debt. They are considering a swap in which Carter makes a fixed-rate payment of 7.25% to Brence and Brence makes a payment of LIBOR to Carter. What are the net payments for Carter and Brence if they engage in the swap? Round your answers to two decimal places. Use a minus sign to enter negative values, if any. Net payment for Carter: - % Net payment for Brence: -(LIBOR + Would Carter be better off if it issued fixed-rate debt or if it issued floating-rate debt and engaged in the swap? The swap is good for Carter, if it issued fixed-rate debt Would Brence be better off if it issued floating-rate debt or if it issued fixed-rate debt and engaged in the swap? The swap is good for Brence, if it iss ued floating-rate debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts