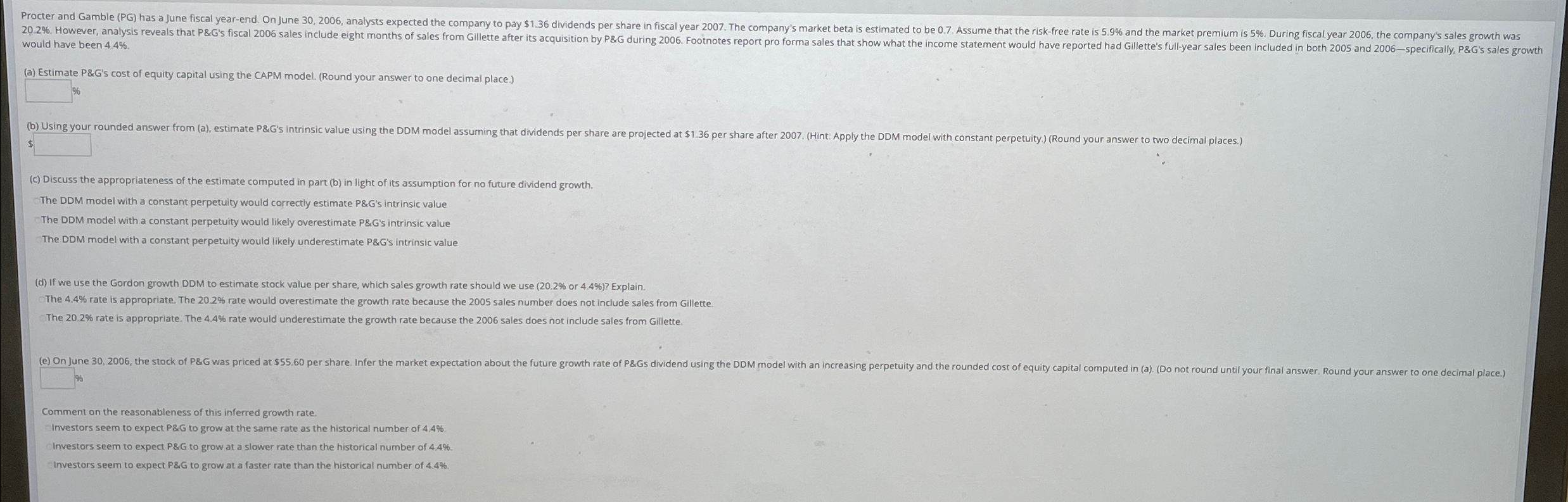

Question: would have been 4 . 4 % ( a ) Estimate P&G ' s cost of equity capital using the CAPM model. ( Round your

would have been

a Estimate P&Gs cost of equity capital using the CAPM model. Round your answer to one decimal place.

c Discuss the appropriateness of the estimate computed in part b in light of its assumption for no future dividend growth.

The DDM model with a constant perpetuity would correctly estimate P&Gs intrinsic value The DDM model with a constant perpetuity would likely overestimate P&Gs intrinsic value The DDM model with a constant perpetuity would likely underestimate P&Gs intrinsic value

d If we use the Gordon growth DDM to estimate stock value per share, which sales growth rate should we use or Explain. The rate is appropriate. The rate would overestimate the growth rate because the sales number does not inciude sales from Gillette. The rate is appropriate. The rate would underestimate the growth rate because the sales does not include sales from Gillette.

Comment on the reasonableness of this inferred growth rate Investors seem to expect P&G to grow at the same rate as the historical number of Investors seem to expect P&G to grow at a slower rate than the historical number of Investors seem to expect P&G to grow at a faster rate than the historical number of

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock