Question: Would like help with d-f Thanks! 5. Index model, tracking portfolio: You determine that the beta of Costco (COST) is 0.7. You also determine that

Would like help with d-f

Would like help with d-f

Thanks!

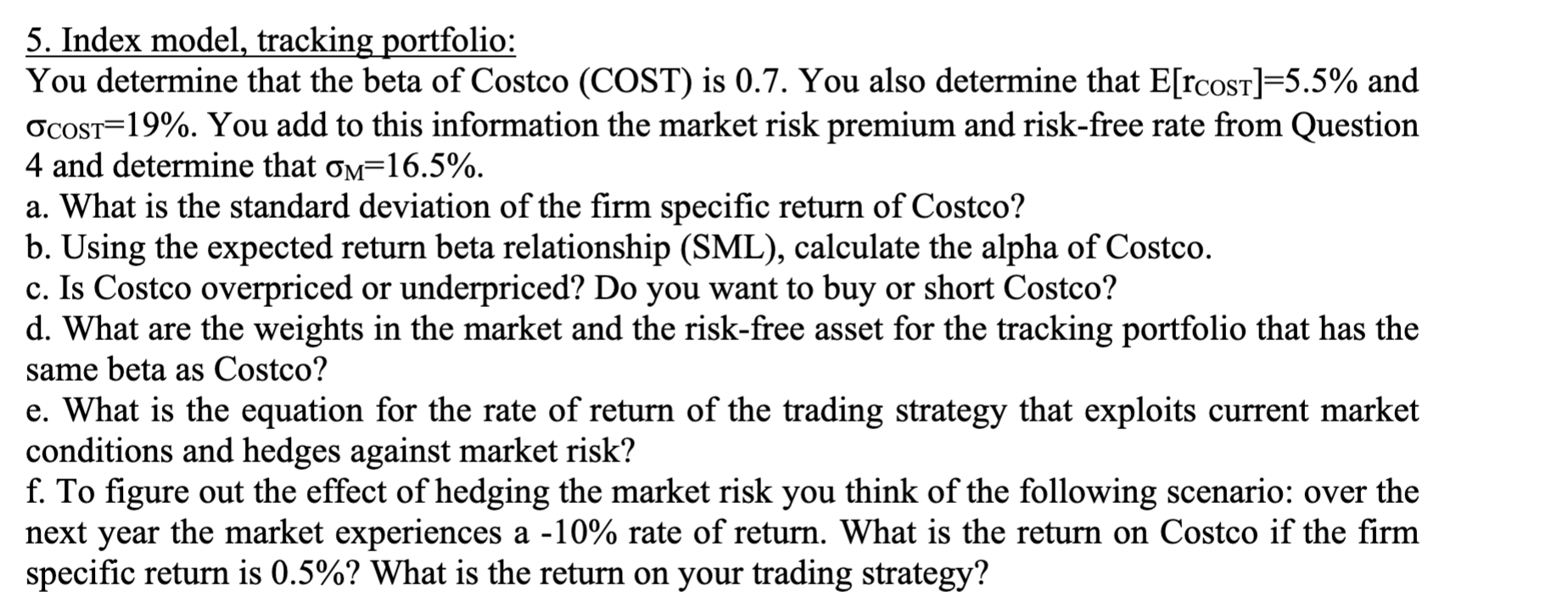

5. Index model, tracking portfolio: You determine that the beta of Costco (COST) is 0.7. You also determine that E[rcost]=5.5% and OcOST=19%. You add to this information the market risk premium and risk-free rate from Question 4 and determine that om=16.5%. a. What is the standard deviation of the firm specific return of Costco? b. Using the expected return beta relationship (SML), calculate the alpha of Costco. c. Is Costco overpriced or underpriced? Do you want to buy or short Costco? d. What are the weights in the market and the risk-free asset for the tracking portfolio that has the same beta as Costco? e. What is the equation for the rate of return of the trading strategy that exploits current market conditions and hedges against market risk? f. To figure out the effect of hedging the market risk you think of the following scenario: over the next year the market experiences a -10% rate of return. What is the return on Costco if the firm specific return is 0.5%? What is the return on your trading strategy? 5. Index model, tracking portfolio: You determine that the beta of Costco (COST) is 0.7. You also determine that E[rcost]=5.5% and OcOST=19%. You add to this information the market risk premium and risk-free rate from Question 4 and determine that om=16.5%. a. What is the standard deviation of the firm specific return of Costco? b. Using the expected return beta relationship (SML), calculate the alpha of Costco. c. Is Costco overpriced or underpriced? Do you want to buy or short Costco? d. What are the weights in the market and the risk-free asset for the tracking portfolio that has the same beta as Costco? e. What is the equation for the rate of return of the trading strategy that exploits current market conditions and hedges against market risk? f. To figure out the effect of hedging the market risk you think of the following scenario: over the next year the market experiences a -10% rate of return. What is the return on Costco if the firm specific return is 0.5%? What is the return on your trading strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts