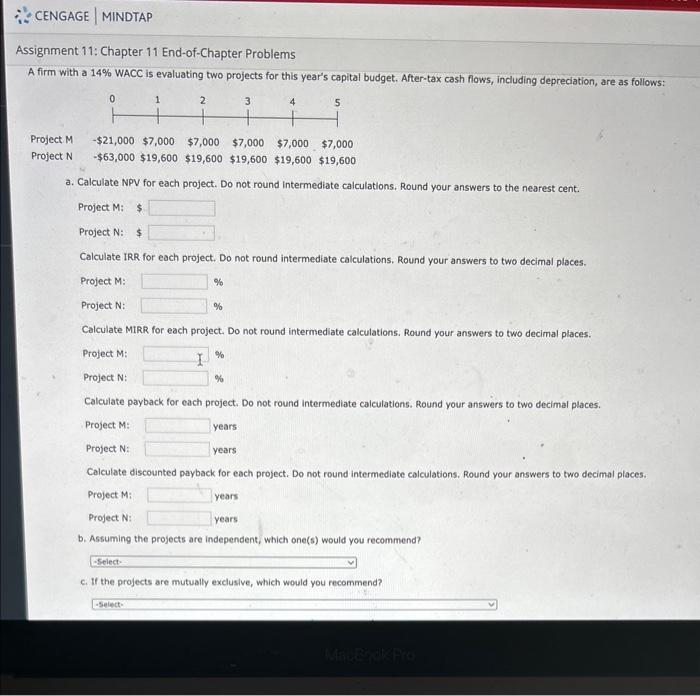

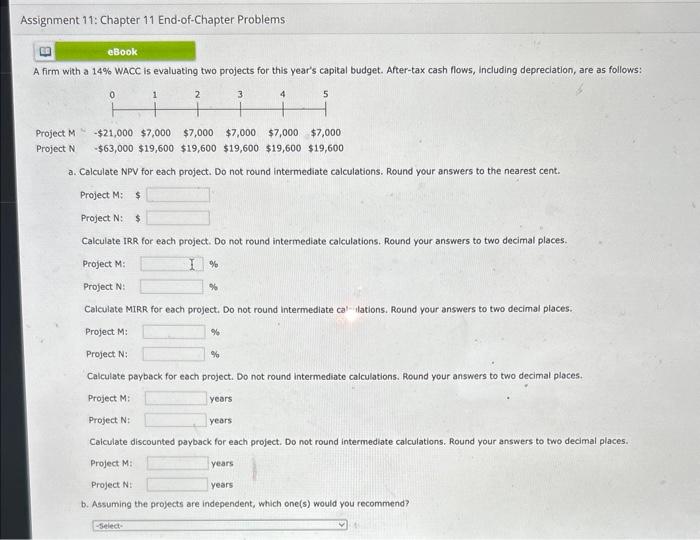

Question: would like solutions to these questions ssignment 11: Chapter 11 End-of-Chapter Problems A firm with a 14% WACC is evaluating two projects for this year's

ssignment 11: Chapter 11 End-of-Chapter Problems A firm with a 14% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreciation, are as follows: a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: $ Project N: $ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: % Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: Project N: Calculate payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. ProjectM:ProjectN:yearsyears Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. ProjectM:ProjectN:yearsyears b. Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend? n with a 14\% WACC is evaluating two projects for this year's capital budget. After-tax cash flows, including depreclation, are as follows: $21,000$63,000$7,000$19,600$7,000$19,600$7,000$19,600$7,000$19,600$7,000$19,600 a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. ProjectM:$ProjectN:$ Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. ProjectM:ProjectN: Calculate MIRR for each project. Do not round intermediate cal-ilations. Round your answers to two decimal places. Project M: Project N: % Calculate payback for each project. Do not round intermediate calculations. Aound your answers to two decimal places. ProjectM:ProjectN:yearsyears Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. ProjectM:ProjectN:yearsyears b. Assuming the projects are independent, which one(s) would you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts