Question: would like the answer computer based, not hand written so its clear QUESTION 3 You can form a portfolio of two assets, A and B,

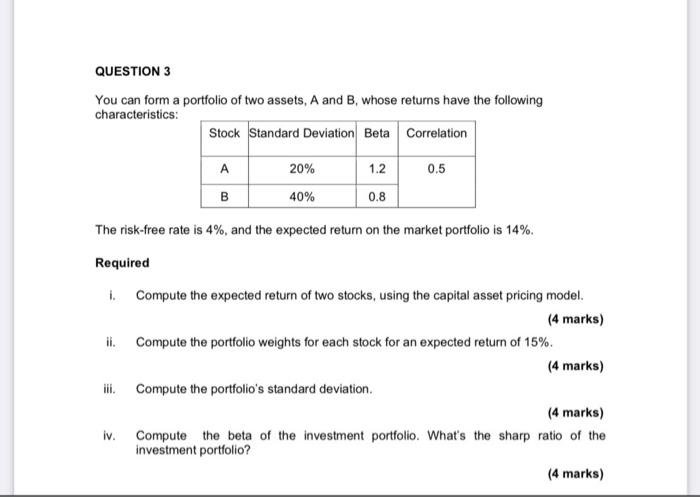

QUESTION 3 You can form a portfolio of two assets, A and B, whose returns have the following characteristics: Stock Standard Deviation Beta Correlation 1.2 0.5 A B 20% 40% 0.8 The risk-free rate is 4%, and the expected return on the market portfolio is 14%. Required Compute the expected return of two stocks, using the capital asset pricing model. (4 marks) ii. Compute the portfolio weights for each stock for an expected return of 15%. (4 marks) Compute the portfolio's standard deviation. (4 marks) Compute the beta of the investment portfolio. What's the sharp ratio of the investment portfolio? (4 marks) iii. iv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts