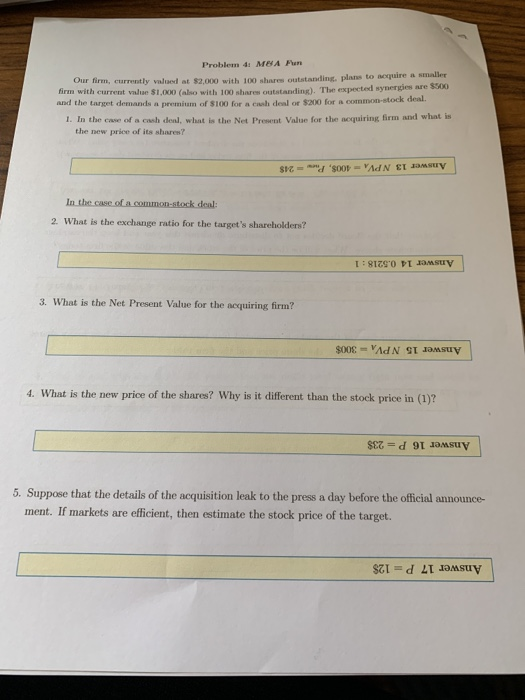

Question: would like this problem solved. have the answer but need a soltution. Tm 4 NH Our firm, currently via at $2,000 with 10 share outstanding

Tm 4 NH Our firm, currently via at $2,000 with 10 share outstanding plans to acquire a smaller firm with current value $1.000 (also with 10) sho u tstanding). The expected synergies are $300 and the target demands a premium of 100 for a cal deal ar 200 for common stock deal. 1. In the case of a cash den, what is the Net Pret Value for the acquiring firm and what is the new price of its shares? SKT SOORYAN ET MUY In the case of a common stock den: 2. What is the exchange ratio for the target's shareholders? T: SIZSO DI MSUV 3. What is the Net Present Value for the acquiring firm? $008 = VAN ST MUY 4. What is the new price of the shares? Why is it different than the stock price in (1) SEZ = d 91 MSUV 5. Suppose that the details of the acquisition leak to the press a day before the official announce ment. If markets are efficient, then estimate the stock price of the target. SZI = d 21 MSUY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts