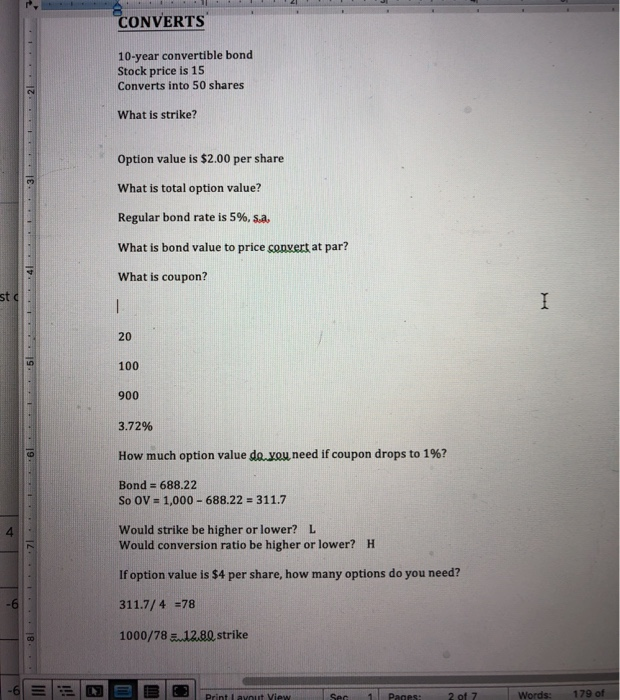

Question: would like this to be fully explained please and thank you! CONVERTS 10-year convertible bond Stock price is 15 Converts into 50 shares What is

CONVERTS 10-year convertible bond Stock price is 15 Converts into 50 shares What is strike? Option value is $2.00 per share What is total option value? Regular bond rate is 5%, sa. What is bond value to price convert at par? What is coupon? st 20 100 900 3.72% How much option value da.you need if coupon drops to 1%? Bond 688.22 1,000-688.22 311.7 So L Would strike be higher or lower? 4 Would conversion ratio be higher or lower? H If option value is $4 per share, how many options do you need? 311.7/478 1000/78 E 1280 strike Words: 179 of CONVERTS 10-year convertible bond Stock price is 15 Converts into 50 shares What is strike? Option value is $2.00 per share What is total option value? Regular bond rate is 5%, sa. What is bond value to price convert at par? What is coupon? st 20 100 900 3.72% How much option value da.you need if coupon drops to 1%? Bond 688.22 1,000-688.22 311.7 So L Would strike be higher or lower? 4 Would conversion ratio be higher or lower? H If option value is $4 per share, how many options do you need? 311.7/478 1000/78 E 1280 strike Words: 179 of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts