Question: would love some expert help please! ! Required information [The following information applies to the questions displayed below.) In 2010 Casey made a taxable gift

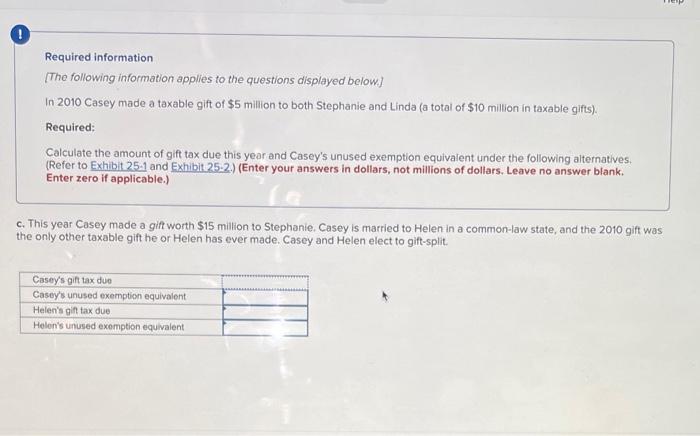

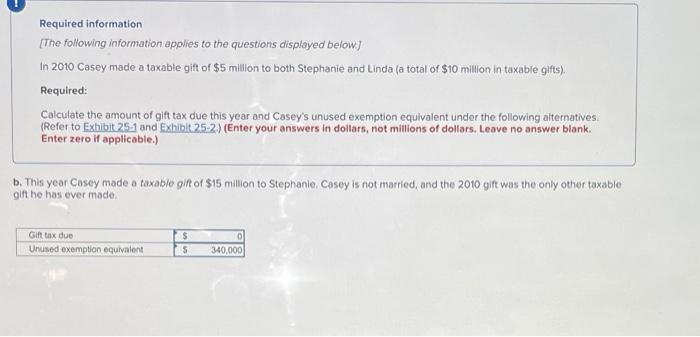

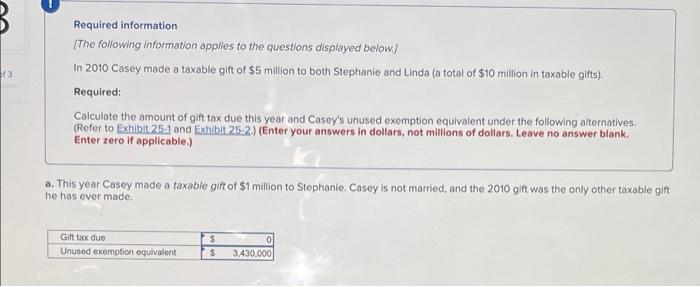

! Required information [The following information applies to the questions displayed below.) In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts). Required: Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2.) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) This year Casey made a gift worth $15 million to Stephanie. Casey is married to Helen in a common-law state, and the 2010 gift was the only other taxable gift he or Helen has ever made. Casey and Helen elect to gift-split. Casey's gift tax due Casey's unused exemption equivalent Helen's gift tax due Helen's unused exemption equivalent Required information [The following information applies to the questions displayed below] In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts). Required: Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) b. This year Casey made a taxable gift of $15 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due $ 0 Unused exemption equivalent S 340,000 13 Required information [The following information applies to the questions displayed below.] In 2010 Casey made a taxable gift of $5 million to both Stephanie and Linda (a total of $10 million in taxable gifts). Required: Calculate the amount of gift tax due this year and Casey's unused exemption equivalent under the following alternatives. (Refer to Exhibit 25-1 and Exhibit 25-2) (Enter your answers in dollars, not millions of dollars. Leave no answer blank. Enter zero if applicable.) a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the 2010 gift was the only other taxable gift he has ever made. Gift tax due $ 0 Unused exemption equivalent S 3,430,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts