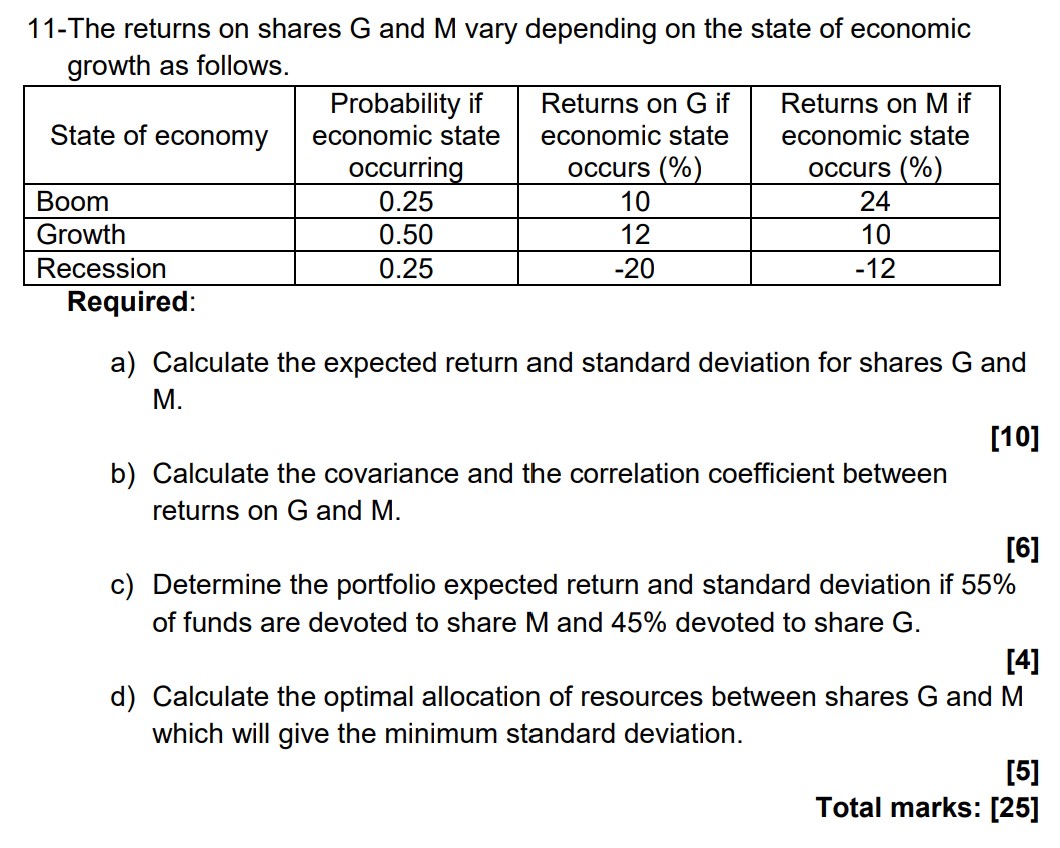

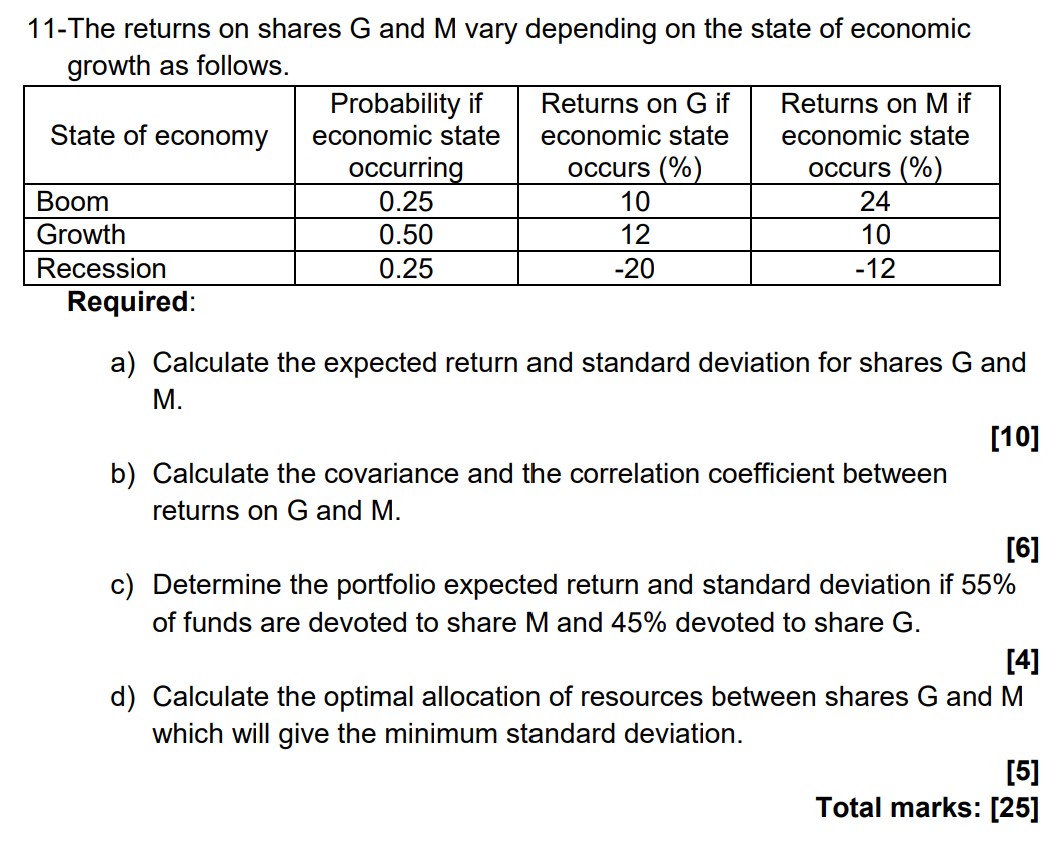

Question: Would love some help on this question please! 11-The returns on shares G and M vary depending on the state of economic growth as follows.

Would love some help on this question please!

11-The returns on shares G and M vary depending on the state of economic growth as follows. Probability if Returns on G if Returns on M if State of economy economic state economic state economic state occu rrin- occurs % occurs % __ Required. a) Calculate the expected return and standard deviation for shares G and M. [10] b) Calculate the covariance and the correlation coefficient between returns on G and M. [6] c) Determine the portfolio expected return and standard deviation if 55% of funds are devoted to share M and 45% devoted to share G. [4] d) Calculate the optimal allocation of resources between shares G and M which will give the minimum standard deviation. [5] Total marks: [25]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts