Question: Would somebody be able to explain how the answer is derived? thank you! QUESTION Cash Flow Statement and Analysis Retail Limited Extracts from the Income

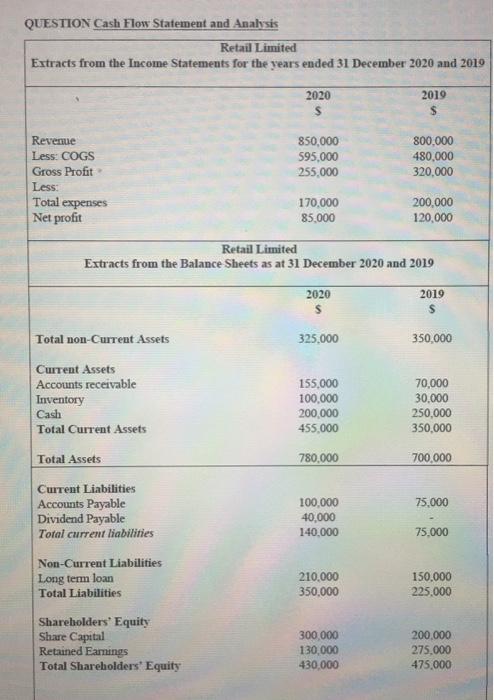

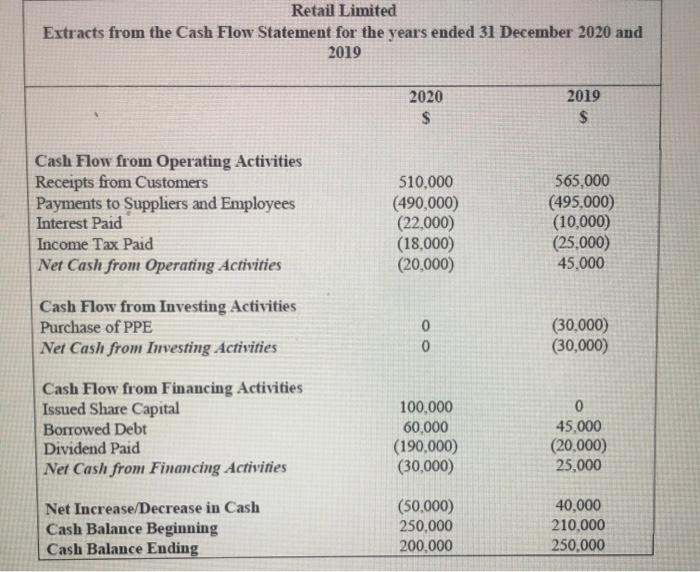

QUESTION Cash Flow Statement and Analysis Retail Limited Extracts from the Income Statements for the years ended 31 December 2020 and 2019 2019 2020 S Revenue Less: COGS Gross Profit Less: Total expenses Net profit 850,000 595,000 255,000 800.000 480,000 320,000 170,000 85,000 200,000 120,000 Retail Limited Extracts from the Balance Sheets as at 31 December 2020 and 2019 2019 2020 $ Total non-Current Assets 325,000 350,000 Current Assets Accounts receivable Inventory Cash Total Current Assets 155,000 100,000 200,000 455,000 70,000 30,000 250,000 350,000 Total Assets 780,000 700.000 75,000 Current Liabilities Accounts Payable Dividend Payable Total current liabilities 100,000 40,000 140,000 75,000 Non-Current Liabilities Long term loan Total Liabilities 210,000 350,000 150.000 225,000 Shareholders' Equity Share Capital Retained Earnings Total Shareholders' Equity 300.000 130,000 430,000 200.000 275,000 475,000 4. Comment on how the company is financing its operating and investing activities in 2020 and 2019 (2 marks). In 2020: The company uses its existing cash balance to finance operations and the payment. of the dividend. In 2019: The company uses the cash flow from operations to finance its investing activities. Retail Limited Extracts from the Cash Flow Statement for the years ended 31 December 2020 and 2019 2020 $ 2019 $ Cash Flow from Operating Activities Receipts from Customers Payments to Suppliers and Employees Interest Paid Income Tax Paid Net Cash from Operating Activities 510,000 (490,000) (22,000) (18,000) (20,000) 565,000 (495,000) (10,000) (25,000) 45,000 Cash Flow from Investing Activities Purchase of PPE Net Cash from Investing Activities 0 0 (30,000) (30,000) Cash Flow from Financing Activities Issued Share Capital Borrowed Debt Dividend Paid Net Cash from Financing Activities 100,000 60.000 (190,000) (30,000) 0 45,000 (20,000) 25,000 Net Increase/Decrease in Cash Cash Balance Beginning Cash Balance Ending (50,000) 250,000 200,000 40,000 210,000 250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts