Question: Would someone be able to help me with this Financial Analysis with R Software Question that builds a pure time series model for a monthly

Would someone be able to help me with this Financial Analysis with R Software Question that builds a pure time series model for a monthly mortgage rate ? Thank you very much.

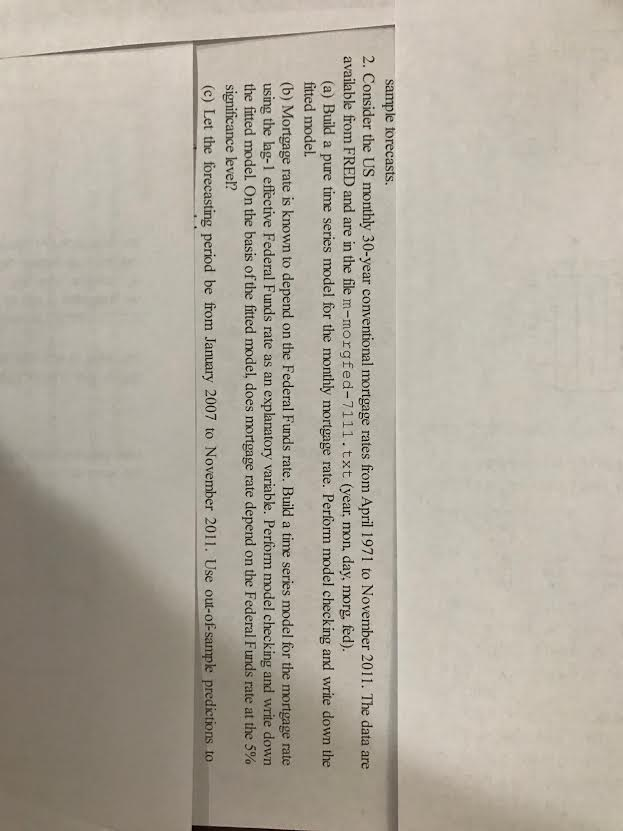

sample torecasts. 2. Consider the US monthly 30-year conventional mortgage rates from April 1971 to November 2011. The data are available from FRED and are in the file m-morgfed-7111.txt (year, mon, day, morg, fed). (a) Build a pure time series model for the monthly mortgage rate. Perform model checking and write down the fitted model. (b) Mortgage rate is known to depend on the Federal Funds rate. Build a time series model for the mortgage rate using the lag-1 effective Federal Funds rate as an explanatory variable. Perform model checking and write down the fitted model On the basis ofthe fitted model, does mortgage rate depend on the Federal Funds rate at the 5% significance level? (c) Let the forecasting period be from January 2007 to November 2011. Use out-of-sample predictions to sample torecasts. 2. Consider the US monthly 30-year conventional mortgage rates from April 1971 to November 2011. The data are available from FRED and are in the file m-morgfed-7111.txt (year, mon, day, morg, fed). (a) Build a pure time series model for the monthly mortgage rate. Perform model checking and write down the fitted model. (b) Mortgage rate is known to depend on the Federal Funds rate. Build a time series model for the mortgage rate using the lag-1 effective Federal Funds rate as an explanatory variable. Perform model checking and write down the fitted model On the basis ofthe fitted model, does mortgage rate depend on the Federal Funds rate at the 5% significance level? (c) Let the forecasting period be from January 2007 to November 2011. Use out-of-sample predictions to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts