Question: would someone mind helping me with this problem. I can't seem to get it. Your company has just signed a three-year nonrenewable contract with the

would someone mind helping me with this problem. I can't seem to get it.

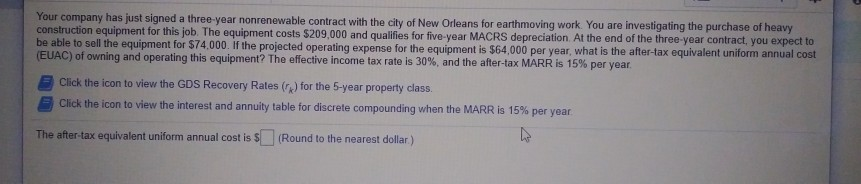

Your company has just signed a three-year nonrenewable contract with the city of New Orleans for earthmoving work. You are investigating the purchase of heavy construction equipment for this job. The equipment costs $209,000 and qualifies for five-year MACRS depreciation. At the end of the three-year contract, you expect to be able to sell the equipment for $74.000. If the projected operating expense for the equipment is $64,000 per year, what is the after-tax equivalent uniform annual cost (EUAC) of owning and operating this equipment? The effective income tax rate is 30%, and the after-tax MARR is 15% per year. Click the icon to view the GDS Recovery Rates (r) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 15% per year The after-tax equivalent uniform annual cost is $ (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts