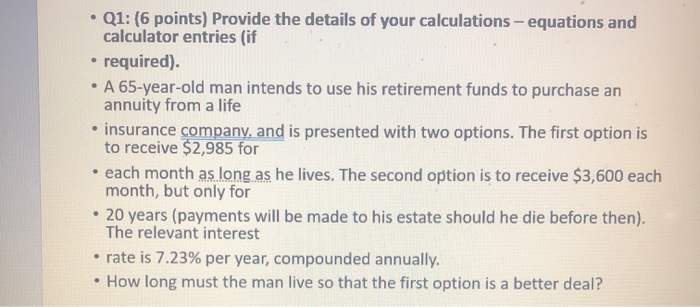

Question: Would to know the answer plus the steps please. . Q1: (6 points) Provide the details of your calculations equations and calculator entries (if required).

. Q1: (6 points) Provide the details of your calculations equations and calculator entries (if required). A 65-year-old man intends to use his retirement funds to purchase an annuity from a life insurance company, and is presented with two options. The first option is to receive $2,985 for each month as long as he lives. The second option is to receive $3,600 each month, but only for 20 years (payments will be made to his estate should he die before then). The relevant interest rate is 7.23% per year, compounded annually. How long must the man live so that the first option is a better deal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts