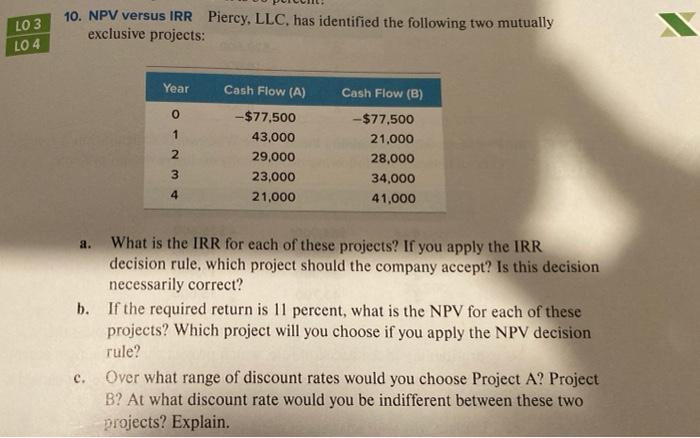

Question: would you also please explain how to do it in exacl LO3 LO4 10. NPV versus IRR Piercy, LLC, has identified the following two mutually

LO3 LO4 10. NPV versus IRR Piercy, LLC, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 1 WN -$77,500 43,000 29,000 23.000 21,000 -$77,500 21.000 28,000 34.000 41.000 4 a. What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept? Is this decision necessarily correct? b. If the required return is 11 percent, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision rule? Over what range of discount rates would you choose Project A? Project B? At what discount rate would you be indifferent between these two projects? Explain. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts