Question: Would you enter this trade? Explain Binomial Option Pricing Model Questions Known = Underlying Stock o Current Stock Price: S = $57.00 o Positive Outlook

Would you enter this trade? Explain

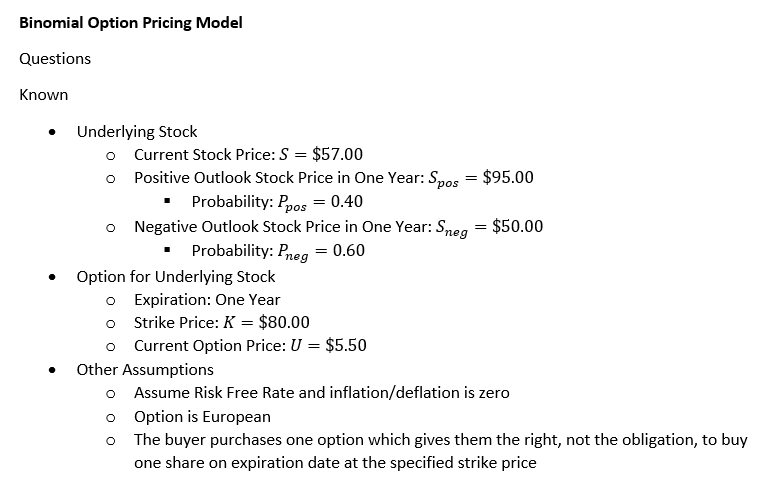

Binomial Option Pricing Model Questions Known = Underlying Stock o Current Stock Price: S = $57.00 o Positive Outlook Stock Price in One Year: Spos = $95.00 Probability: Ppos = 0.40 Negative Outlook Stock Price in One Year: Sneg = $50.00 Probability: Pneg 0.60 Option for Underlying Stock o Expiration: One Year o Strike Price: K = $80.00 o Current Option Price: U = $5.50 Other Assumptions o Assume Risk Free Rate and inflation/deflation is zero o Option is European The buyer purchases one option which gives them the right, not the obligation, to buy one share on expiration date at the specified strike price O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts