Question: would you mind if you help me with the read cells, I cloud not solve it, with explanation please ------------- Also another question Exercise 2-2

would you mind if you help me with the read cells, I cloud not solve it, with explanation please

would you mind if you help me with the read cells, I cloud not solve it, with explanation please

-------------

Also another question

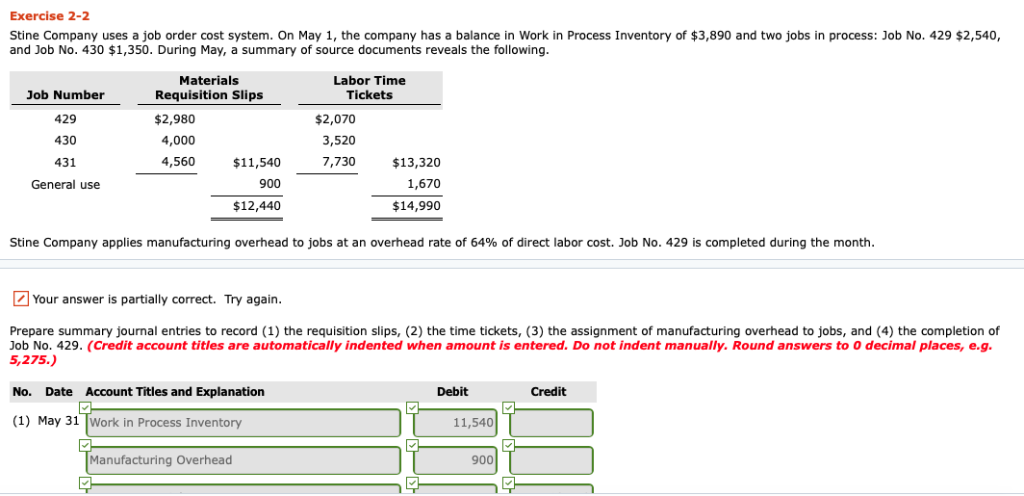

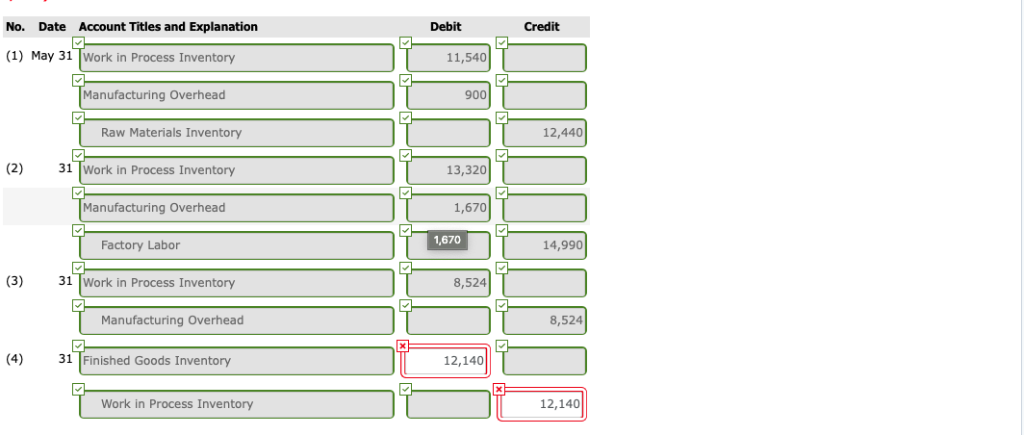

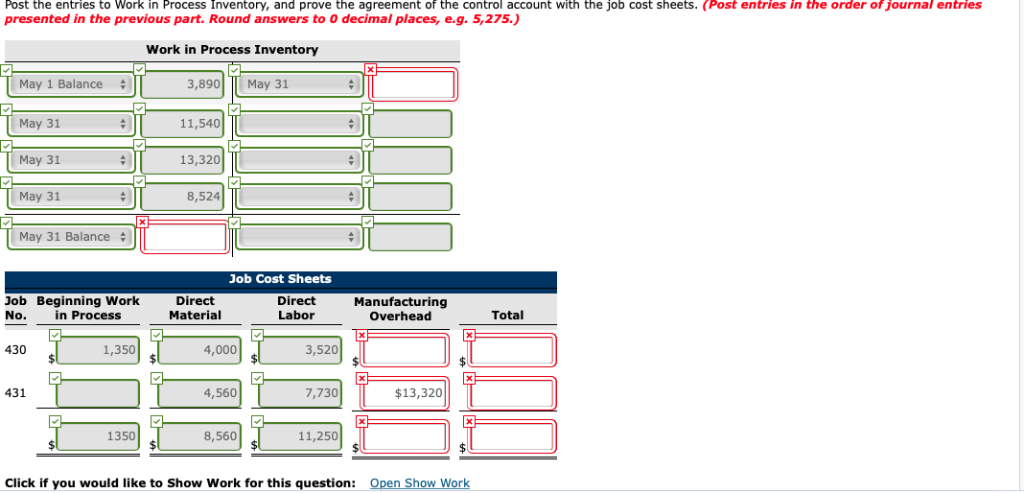

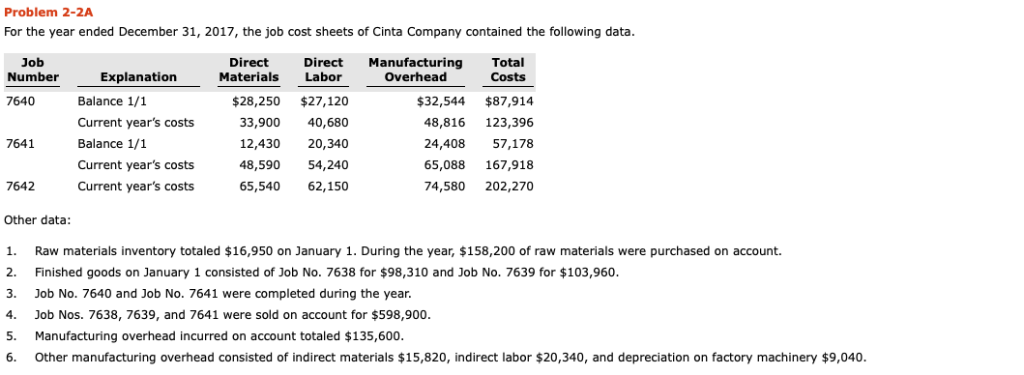

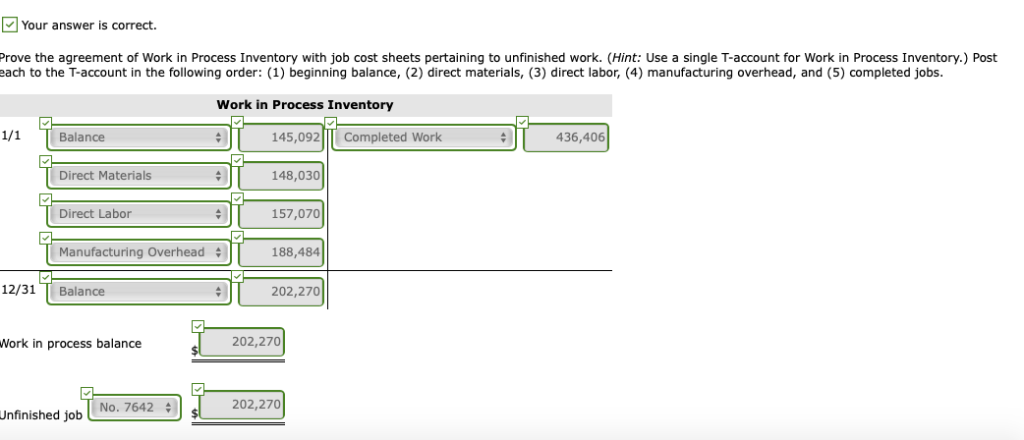

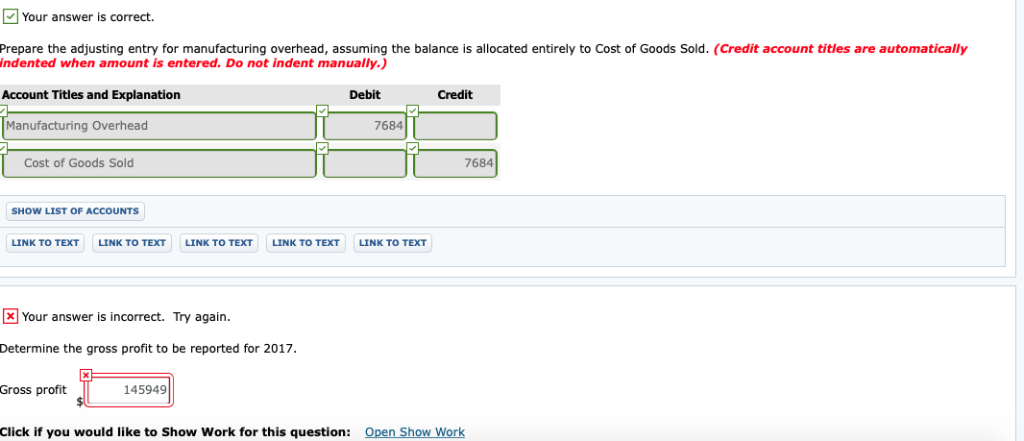

Exercise 2-2 Stine Company uses a job order cost system. On May 1, the company has a balance in Work in Process Inventory of $3,890 and two jobs in process: Job No. 429 $2,540, and Job No. 430 $1,350. During May, a summary of source documents reveals the following Materials Requisition Slips Labor Time Tickets Job Number 429 430 431 General use $2,070 3,520 7,730 $2,980 4,000 4,560 $11,540 900 $12,440 $13,320 1,670 $14,990 Stine Company applies manufacturing overhead to jobs at an overhead rate of 64% of direct labor cost. Job No. 429 is completed during the month Your answer is partially correct. Try again Prepare summary journal entries to record (1) the requisition slips, (2) the time tickets, (3) the assignment of manufacturing overhead to jobs, and (4) the completion of Job No. 429. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places, e.g 5,275.) No. Date Account Titles and Explanation Debit Credit (1) May 31 Work in Process Inventory 11,540 Manufacturing Overhead 900 No. Date Account Titles and Explanation Debit Credit (1) May 31 Work in Process Inventory 11,540 Manufacturing Overhead 900 Raw Materials Inventory 12,440 (2) 31 Work in Process Inventory 13,320 Manufacturing Overhead 1,670 Factory Labor 14,990 (3) 31 Work in Process Inventory 8,524 Manufacturing Overhead 8,524 (4) 31 Finished Goods Inventory 12,140 Work in Process Inventory 12,140 Post the entries to Work in Process Inventory, and prove the agreement of the control account with the job cost sheets. (Post entries in the order of journal entries presented in the previous part. Round answers to O decimal places, e.g. 5,275.) Work in Process Inventory May 1 Balance 3,890May 31 May 31 May 31 May 31 11,540 13,320 8,524 May 31 Balance #1 Job Cost Sheets Job Beginning Work No Direct Material Direct Labor Manufacturing Overhead in Process Total 430 1,350 4,000 3,520 431 4,560 7,730 $13,320 1350 8,560 11,250 Click if you would like to Show Work for this question Problem 2-2A For the year ended December 31, 2017, the job cost sheets of Cinta Company contained the following data Job Number Direct Materials Labor Direct Manufacturing Total Overhead Explanation Costs Balance 1/1 Current year's costs Balance 1/1 Current year's costs Current year's costs 7640 $28,250 $27,120 33,900 40,680 12,430 20,340 48,590 54,240 65,540 62,150 $32,544 $87,914 48,816 123,396 24,408 57,178 65,088 167,918 74,580 202,270 7641 7642 Other data 1. Raw materials inventory totaled $16,950 on January 1. During the year, $158,200 of raw materials were purchased on account. 2. Finished goods on January 1 consisted of Job No. 7638 for $98,310 and Job No. 7639 for $103,960 3. Job No. 7640 and Job No. 7641 were completed during the year 4. Job Nos. 7638, 7639, and 7641 were sold on account for $598,900 5. Manufacturing overhead incurred on account totaled $135,600 6. Other manufacturing overhead consisted of indirect materials $15,820, indirect labor $20,340, and depreciation on factory machinery $9,040. Your answer is correct. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. (Hint: Use a single T-account for Work in Process Inventory.) Post each to the T-account in the following order: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs. Work in Process Inventory 1/1 Balance 145,092Completed Work 436,406 Direct Materials 148,030 Direct Labor 157,070 Manufacturing Overhead 188,484 12/31 Balance 202,270 Work in process balance 202,270 Unfinished job No. 7642 Your answer is correct. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Manufacturing Overhead Debit Credit 7684 Cost of Goods Sold 7684 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXTLINK TO TEXT LINK TO TEXT Your answer is incorrect. Try again. Determine the gross profit to be reported for 2017 Gross profit Click if you would like to Show Work for this question: 145949 Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts