Question: Would you mind to help me solve question ABCD together? which $180,000 represented 25187 23v0 A. The total payroll of Trolley Company for the month

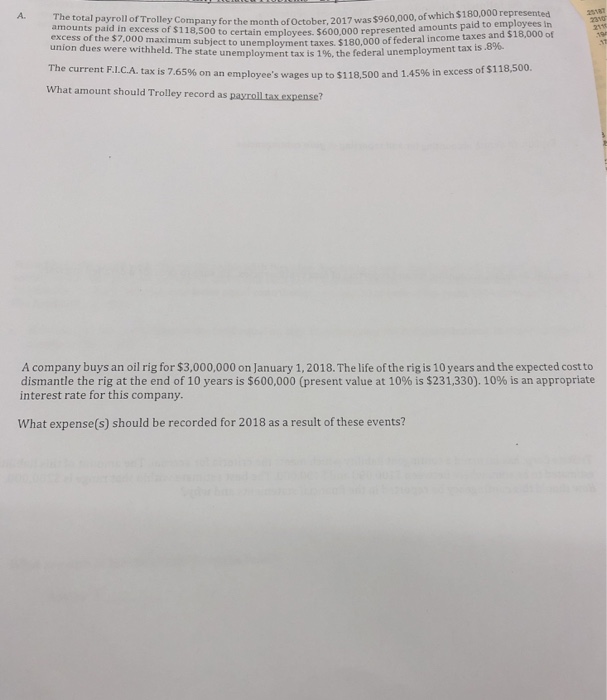

which $180,000 represented 25187 23v0 A. The total payroll of Trolley Company for the month of October, 2017 was $960,000, of employees. $600,000 represented amounts paid to employees in $180,000 of federal income taxes and $18,000 of amounts paid in excess of $118,500 to $ union dues were withheld. The state unemployment tax is 1%. the federal u The current F.LC.A-tax is 7.65% on What amount should Trolley record as payroll tax.expense? e $7,000 maximum sub ceai nemployment tax is .8%. an employee's wages up to $118,500 and 1.45% in excess of $118,500. A company buys an oil rig for $3,000,000 on January 1, 2018. The life of the rig is 10 years and the expected cost to dismantle the rig at the end of 10 years is $600,000 (present value at 10% is $231,330), 10% is an appropriate interest rate for this company What expense(s) should be recorded for 2018 as a result of these events

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts