Question: Would you please help with this complicated question? Bridgeport Leasing Com panyr agrees to lease equ ipme nt to Indigo Corporation 0 n Jan uary

Would you please help with this complicated question?

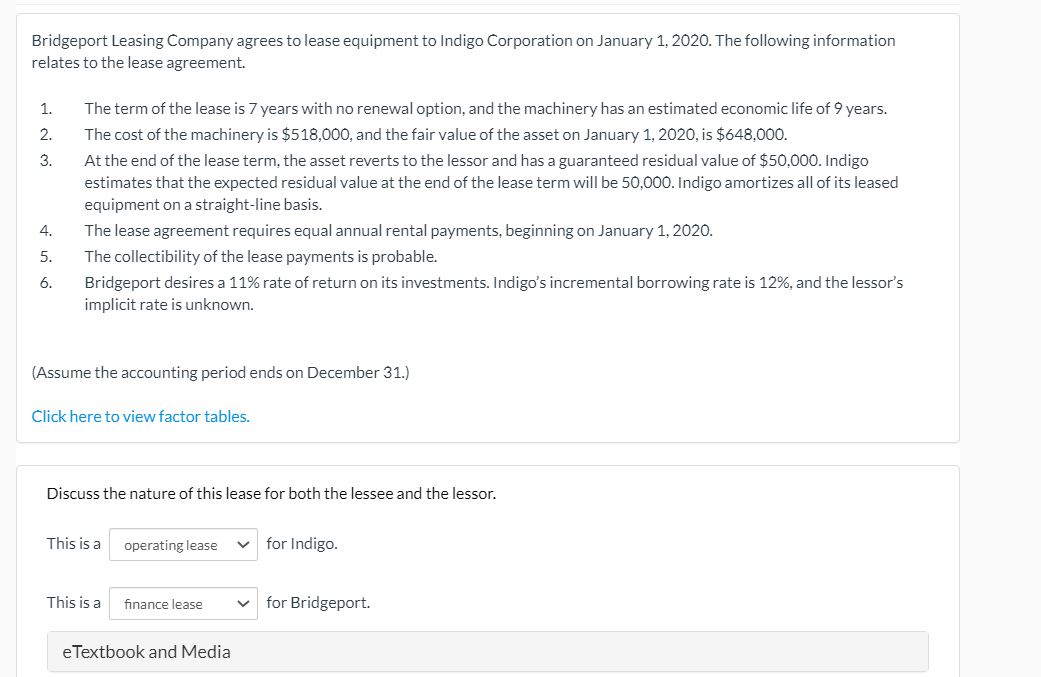

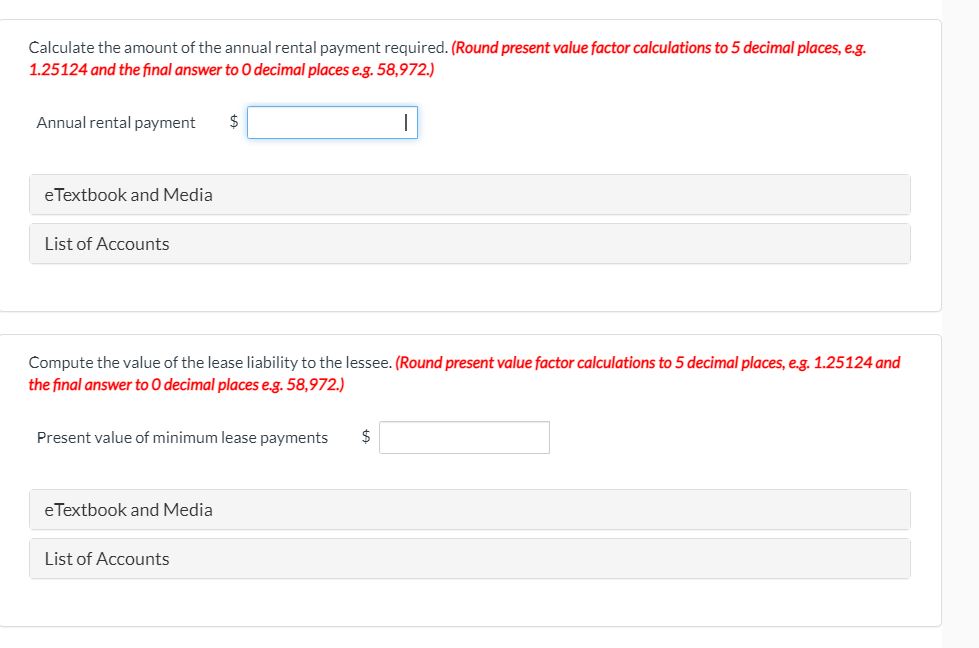

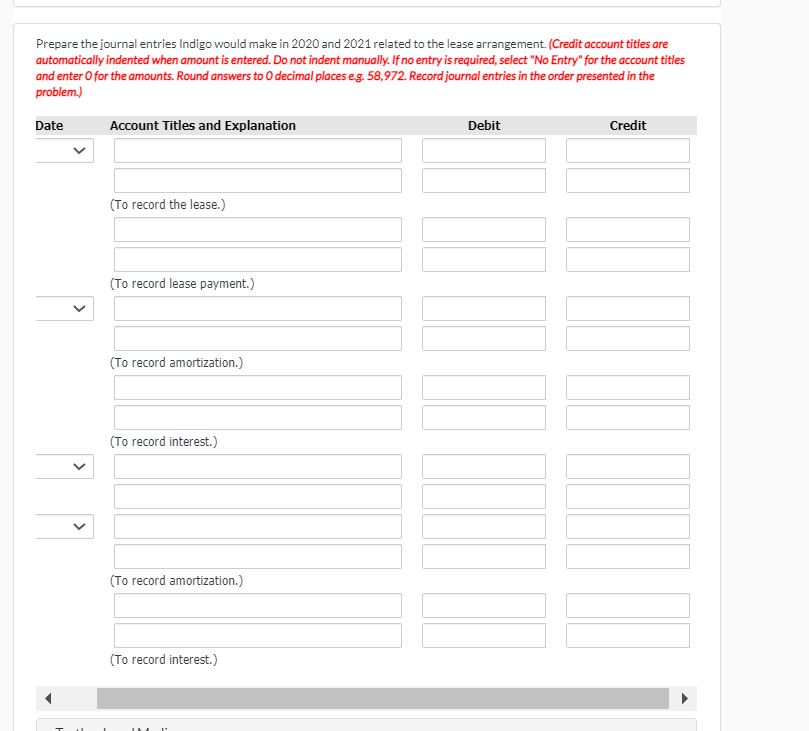

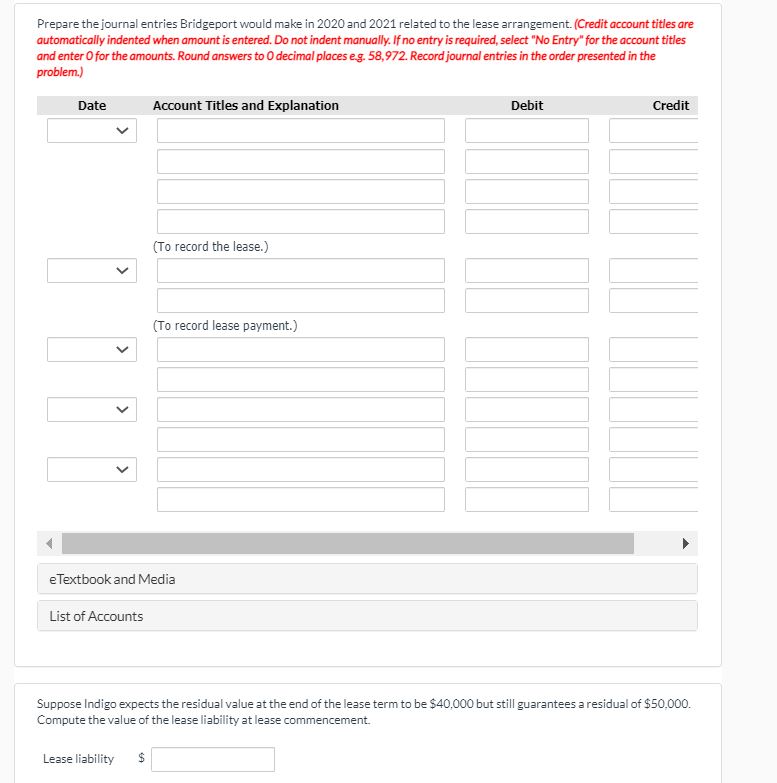

Bridgeport Leasing Com panyr agrees to lease equ ipme nt to Indigo Corporation 0 n Jan uary 1, 2020. The following information relates to the lease agree men t. 1. The term of the lease is 3' years with no renewal option. and the machinery has an estimated economic life of 9 years. 2. The cost of the machinery is $518,000, and the fair value of the asset on January 1, 2020, is $648,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $50,000. Indigo estimates that the expected residual value at the end of the lease term will be 50,000. Indigo amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2020. 5. The collectibility ot the lease payments is probable. 6. Bridgeport desires a 11% rate of return on its investments. Indigo's incremental borrowing rate is 12%, and the Iessor's implicit rate is unknown. {Assume the accounting period ends on December 31.] Click here to View factor tables. Discuss the nature of this lease for both the lessee and the lessor. TI'IISISS operating Eease V l for Indigo. This isa nance lease v | for Bridgeport. eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts