Question: Wouldn't the answer be 47.28? (Calculating capital structure weights) Winchell Investment Advisors is evaluating the capital structure of Ojai Foods. Ojai's balance sheet indicates that

Wouldn't the answer be 47.28?

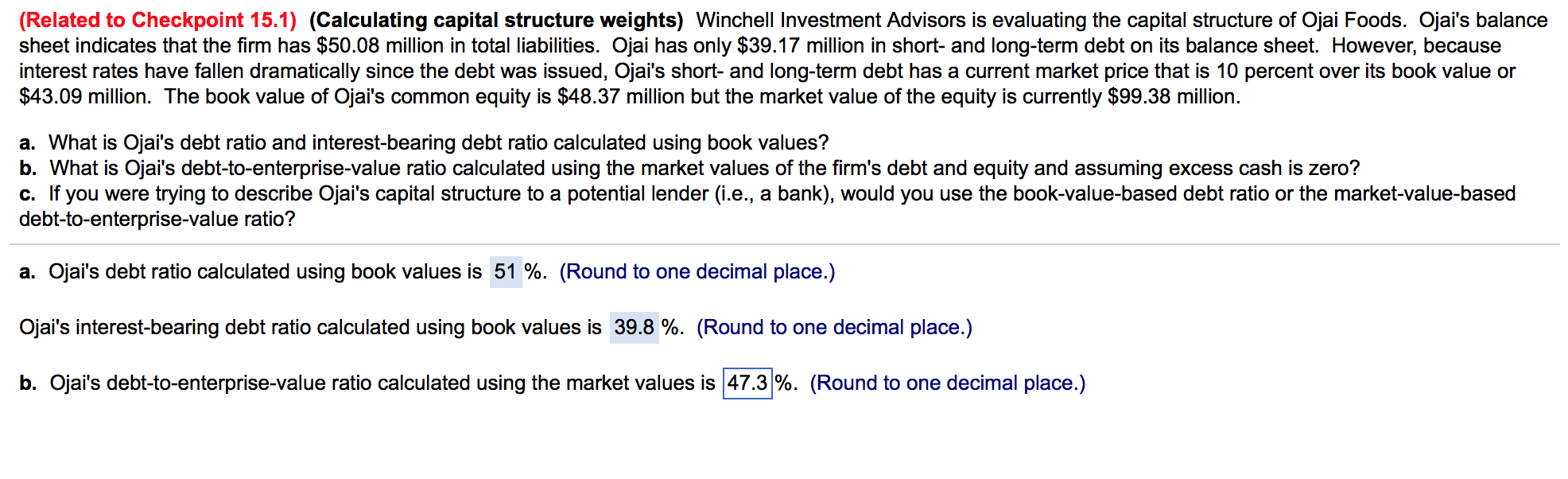

(Calculating capital structure weights) Winchell Investment Advisors is evaluating the capital structure of Ojai Foods. Ojai's balance sheet indicates that the firm has dollar 50.08 million in total liabilities. Ojai has only dollar 39.17 million in short- and long-term debt on its balance sheet. However, because interest rates have fallen dramatically since the debt was issued, Ojai's short- and long-term debt has a current market price that is 10 percent over its book value or dollar 43.09 million. The book value of Ojai's common equity is dollar 48.37 million but the market value of the equity is currently dollar 99.38 million. What is Ojai's debt ratio and interest-bearing debt ratio calculated using book values? What is Ojai's debt-to-enterprise-value ratio calculated using the market values of the firm's debt and equity and assuming excess cash is zero? If you were trying to describe Ojai's capital structure to a potential lender (i.e., a bank), would you use the book-value-based debt ratio or the market-value-based debt-to-enterprise-value ratio? Ojai's debt ratio calculated using book values is 51 percentage. (Round to one decimal place.) Ojai's interest-bearing debt ratio calculated using book values is 39.8 percentage. (Round to one decimal place.) Ojai's debt-to-enterprise-value ratio calculated using the market values is 47.3 percentage. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts