Question: Wprld Class Steaks is a meat processing firm based in Texas. It has two departments: preparation (prep) and shipping. For the prep department conversion costs

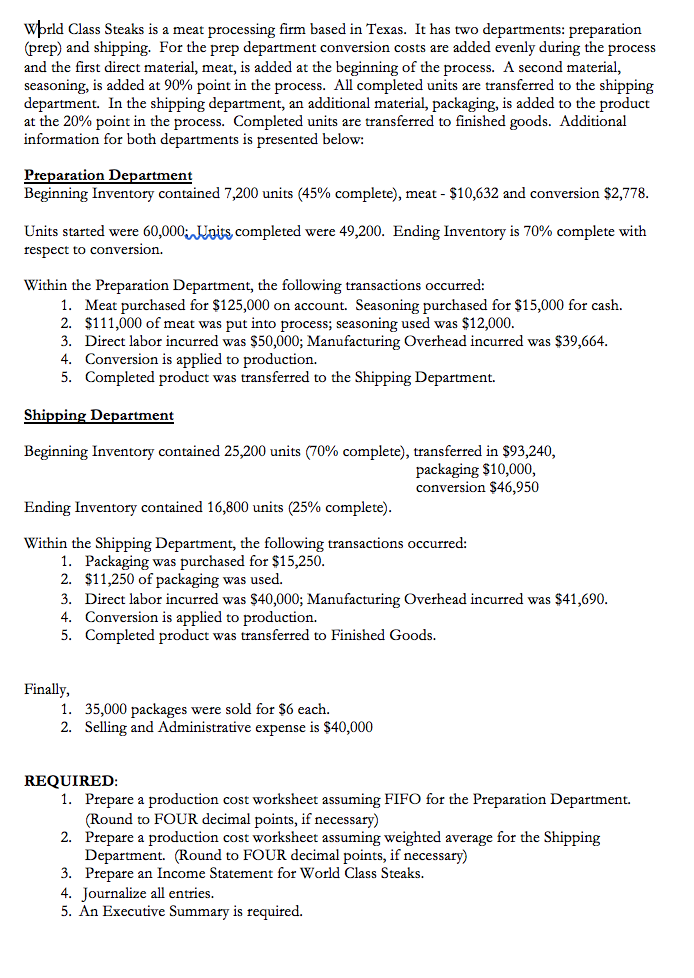

Wprld Class Steaks is a meat processing firm based in Texas. It has two departments: preparation (prep) and shipping. For the prep department conversion costs are added evenly during the process and the first direct material, meat, is added at the beginning of the process. A second material, seasoning, is added at 90% point in the process. All completed units are transferred to the shipping department. In the shipping department, an additional material, packaging, is added to the product at the 20% point in the process. Completed units are transferred to finished goods. Additional information for both departments is presen Preparation Department Beginning inventory contained 7,200 units (45% complete), meat-$10,632 and conversion $2,778 Units started were 60,000, Jews completed were 49,200. Ending Inventory is 70% complete with respect to conversion. Within the Preparation Department, the f ransactions occufred: 1. 2. 3. 4. 5. Meat purchased for $125,000 on account. Seasoning purchased for $15,000 for cash. $111,000 of meat was put into process; seasoning used was $12,000. Direct labor incurred was $50,000; Manufacturing Overhead incurred was $39,664 Conversion is applied to production. Completed product was transferred to the Shipping Department. Shipping Department Beginning inventory contained 25,200 units (70% complete), transferred in $93,240, Ending Inventory contained 16,800 units (25% complete Within the Shipping Department, the following transactions occurred: packaging $10,000, conversion $46,950 1. 2. 3. 4. 5. Packaging was purchased for $15,250 $11,250 of packaging was used. Direct labor incurred was $40,000; Manufacturing Overhead incurred was $41,690 Conversion is applied to production. Completed product was transferred to Finished Goods. Finally, 1. 2. 35,000 packages were sold for $6 each. Selling and Administrative expense is $40,000 REQUIRED Prepare a production cost worksheet assu (Round to FOUR decimal points, if necessary) Prepare a production cost worksheet assuming weighted average for the Shipping Department. (Round to FOUR decimal points, if necessary) g FIFO for the Preparation Department. 2. 3. Prepare an Income Statement for World Class Steaks. 4. Journalize all entries. 5. An Executive Summary is required Wprld Class Steaks is a meat processing firm based in Texas. It has two departments: preparation (prep) and shipping. For the prep department conversion costs are added evenly during the process and the first direct material, meat, is added at the beginning of the process. A second material, seasoning, is added at 90% point in the process. All completed units are transferred to the shipping department. In the shipping department, an additional material, packaging, is added to the product at the 20% point in the process. Completed units are transferred to finished goods. Additional information for both departments is presen Preparation Department Beginning inventory contained 7,200 units (45% complete), meat-$10,632 and conversion $2,778 Units started were 60,000, Jews completed were 49,200. Ending Inventory is 70% complete with respect to conversion. Within the Preparation Department, the f ransactions occufred: 1. 2. 3. 4. 5. Meat purchased for $125,000 on account. Seasoning purchased for $15,000 for cash. $111,000 of meat was put into process; seasoning used was $12,000. Direct labor incurred was $50,000; Manufacturing Overhead incurred was $39,664 Conversion is applied to production. Completed product was transferred to the Shipping Department. Shipping Department Beginning inventory contained 25,200 units (70% complete), transferred in $93,240, Ending Inventory contained 16,800 units (25% complete Within the Shipping Department, the following transactions occurred: packaging $10,000, conversion $46,950 1. 2. 3. 4. 5. Packaging was purchased for $15,250 $11,250 of packaging was used. Direct labor incurred was $40,000; Manufacturing Overhead incurred was $41,690 Conversion is applied to production. Completed product was transferred to Finished Goods. Finally, 1. 2. 35,000 packages were sold for $6 each. Selling and Administrative expense is $40,000 REQUIRED Prepare a production cost worksheet assu (Round to FOUR decimal points, if necessary) Prepare a production cost worksheet assuming weighted average for the Shipping Department. (Round to FOUR decimal points, if necessary) g FIFO for the Preparation Department. 2. 3. Prepare an Income Statement for World Class Steaks. 4. Journalize all entries. 5. An Executive Summary is required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts