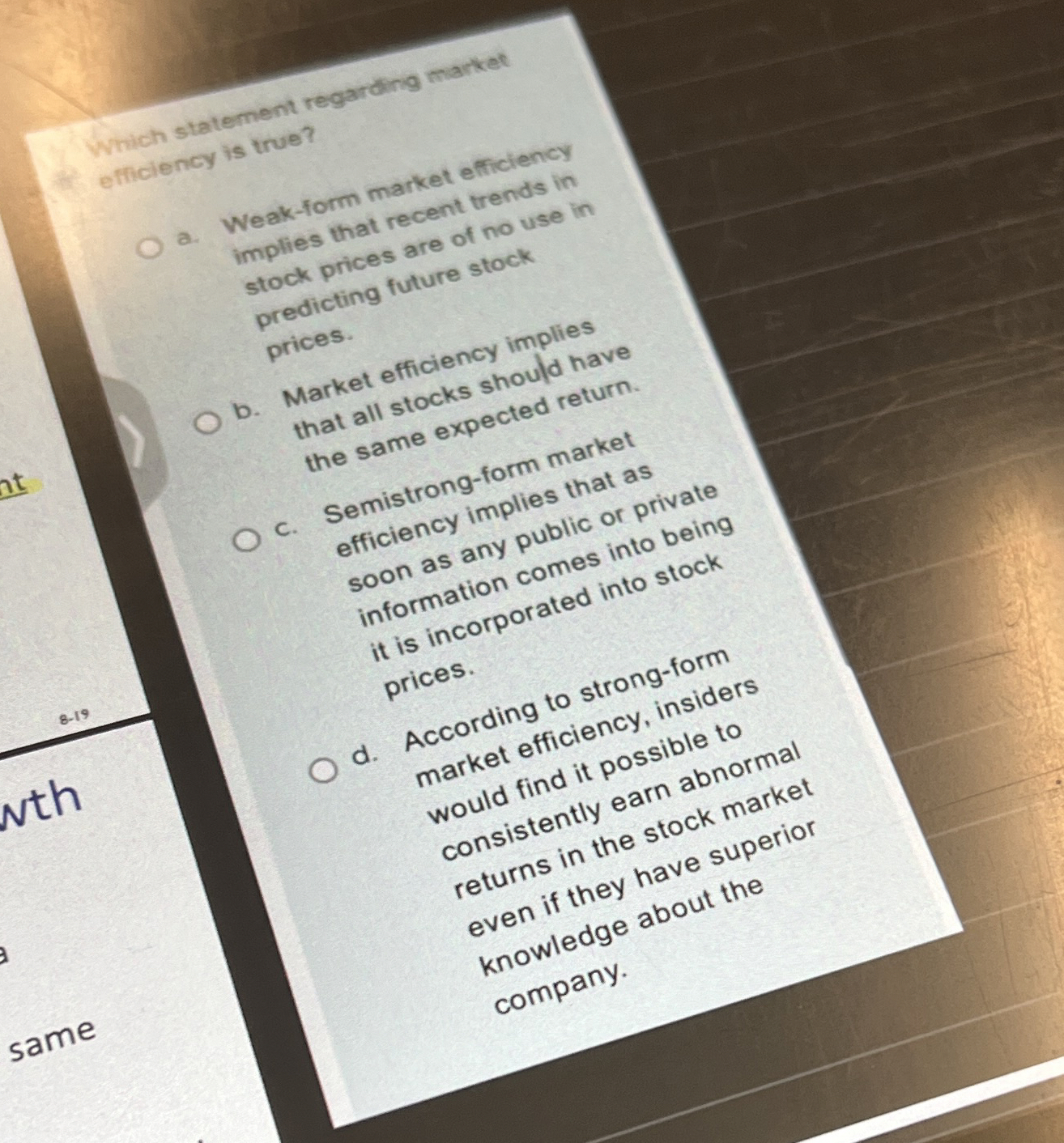

Question: Wrich statement regarding market efticlency is true? a . Weak - form market efficiency implies that recent trends in stock prices are of no use

Wrich statement regarding market efticlency is true?

a Weakform market efficiency implies that recent trends in stock prices are of no use in predicting future stock prices.

b Market efficiency implies that all stocks should have the same expected return.

c Semistrongform market efficiency implies that as soon as any public or private information comes into being it is incorporated into stock prices.

d According to strongform market efficiency, insiders would find it possible to consistently earn abnormal returns in the stock market even if they have superior knowledge about the

same

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock