Question: write a detailed answers Case study #1 : Bonds and Interest Rate Risk Today is Marchl, 2006. Consider the following two (semi-annual coupon) bonds: Bond

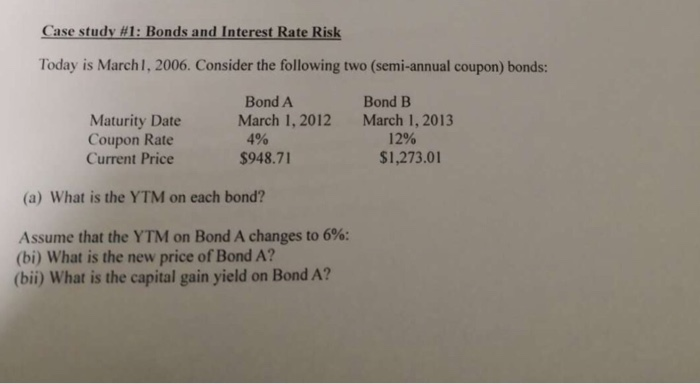

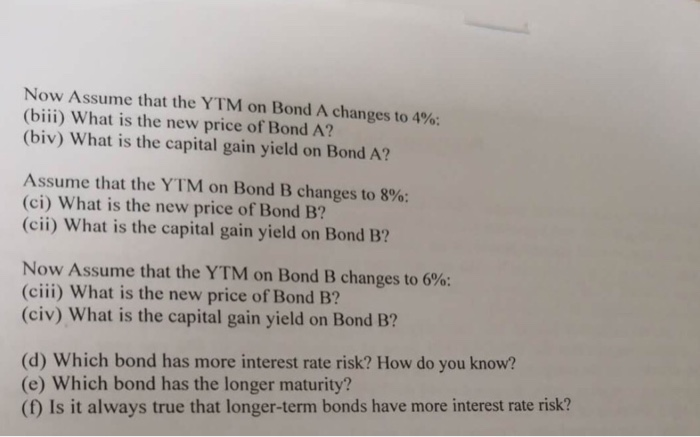

Case study #1 : Bonds and Interest Rate Risk Today is Marchl, 2006. Consider the following two (semi-annual coupon) bonds: Bond A Bond B Maturity Date Coupon Rate Current Price March 1, 2012 March 1, 2013 12% $1,273.01 4% $948.71 (a) What is the YTM on each bond? Assume that the YTM on Bond A changes to 6%; (bi) What is the new price of Bond A? (bii) What is the capital gain yield on Bond A? Now Assume that the YTM on Bond A changes to 4% (biii) What is the new price of Bond A? (biv) What is the capital gain yield on Bond A? Assume that the YTM on Bond B changes to 8%; (ci) What is the new price of Bond B? (cii) What is the capital gain yield on Bond B? Now Assume that the YTM on Bond B changes to 6%: (c iii) What is the new price of Bond B? (civ) What is the capital gain yield on Bond B? (d) Which bond has more interest rate risk? How do you know? (e) Which bond has the longer maturity? (f) Is it always true that longer-term bonds have more interest rate risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts