Question: Write a Java program that will calculate tax for the employees of a company called XYZ. The main menu of the tax calculation program is

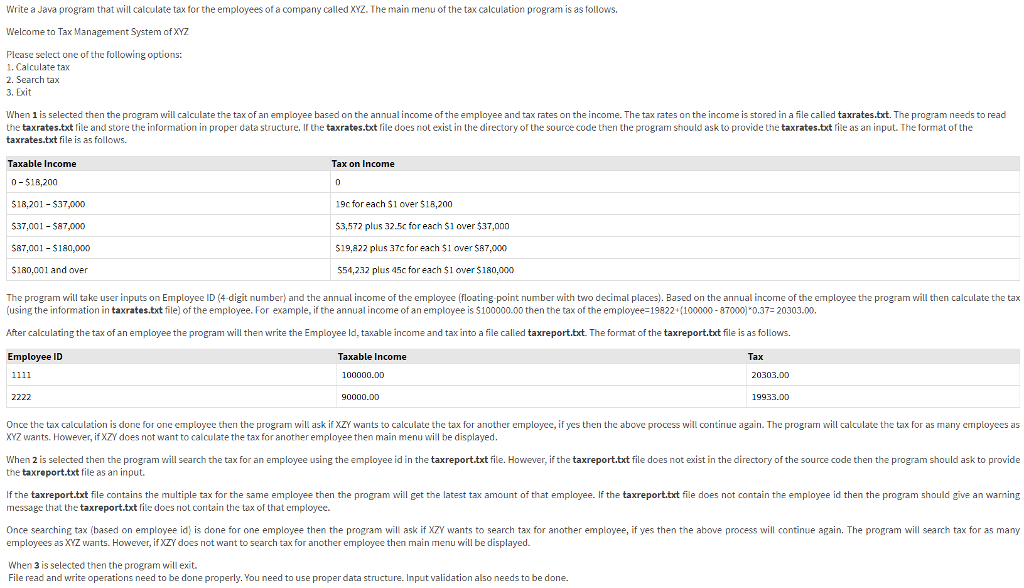

Write a Java program that will calculate tax for the employees of a company called XYZ. The main menu of the tax calculation program is as follows. Welcome to Tax Management System of XYZ Please select one of the following options: 1. Calculate tax 2. Search tax 3. Exit When 1 is selected then the program will calculate the tax of an employee based on the annual income of the employee and tax rates on the income. The tax rates on the income is stored in a file called taxrates.txt. The program needs to read the taxrates.txt lile and store the information in proper data structure. If the taxrates.txt rile does not exist in the directory of the source code then the program should ask to provide the taxrates.tt lile as an input. The format of the taxrates.txt file is as follows Taxable Income Tax on Income 0 $18,200 $18,201 -$37,000 537,001 - S87,000 587,001 -$180,000 $180,001 and over 19c for each $1 over$18,200 53,572 plus 32.5c for each $1 over $37,000 $19,822 plus 37c for each $1 over $87,000 554,232 plus 45c foreach $1 over180,000 The program will take user inputs on Employee ID (4 digit number) and the annual income of the employee (floating point number with two decimal places). Based on the annual income of the employee the program will then calculate the tax (using the information in taxrates.txt file) of the employee. For example, if the annual income of an employee is $100000.00 then the tax of the employee 19822 (100000-87000) 0.37- 20303.00. After calculating the tax of an employee the program will then write the Employee ld, taxable income and tax into a file called taxreport.txt. The format of the taxreport.txt file is as follows. Employee ID Taxable Income Tax 100000.0D 20303.OD 90000.OD 19933.OD Once the tax calculation is done for one employee then the program will ask if XZY wants to calculate the tax for another employee, if yes then the above process will continue again. The program will calculate the tax for as many employees as XYZ wants. However, if XZY does not want to calculate the tax for another employee then main menu will be displayed. When 2 is selected then the program will search the tax for an employee using the employee id in the taxreport.txt file. However, if the taxreport.txt file does not exist in the directory of the source code then the program should ask to provide the taxreport.txt file as an input. If the taxreport.txt file contains the multiple tax for the same employee then the program will get the latest tax amount of that employee. If the taxreport.txt file does not contain the employee id then the program should give an warning message that the taxreport.txt file does not contain the tax of that employee. Once searching tax (sed on employee id is done for one employee then the program will ask if XZY wants to search tax for another employee, if yes then the above process will continue again. The program will search tax for as many employees as XYZ wants. However, if XZY does not want to search tax for another employee then main menu will be displayed. When 3 is selected then the program will exit. File read and write operations need to be done properly. You need to use proper data structure. Input validation also needs to be done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts