Question: Write a JAVA program with a method called fit Switch, which takes an array of Strings as an argument. This method should then return a

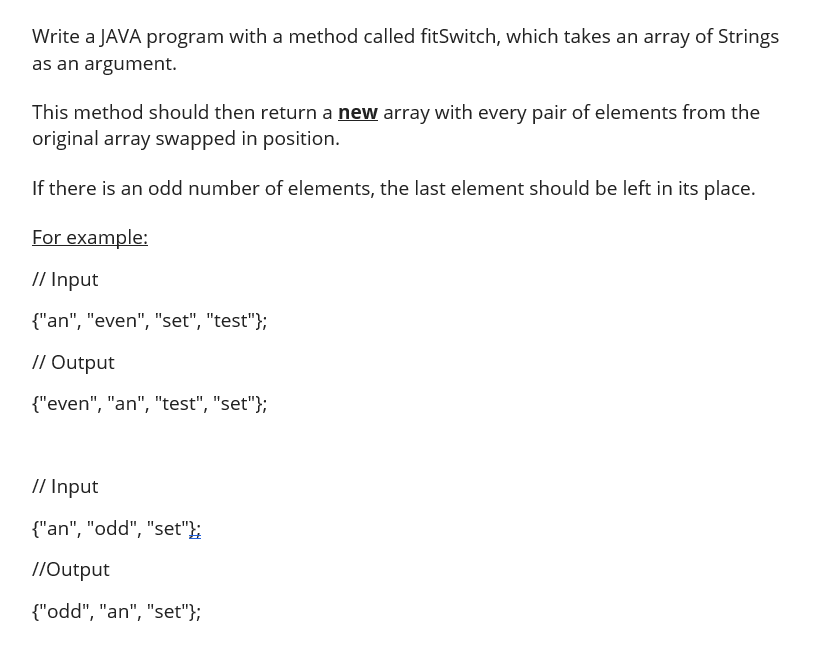

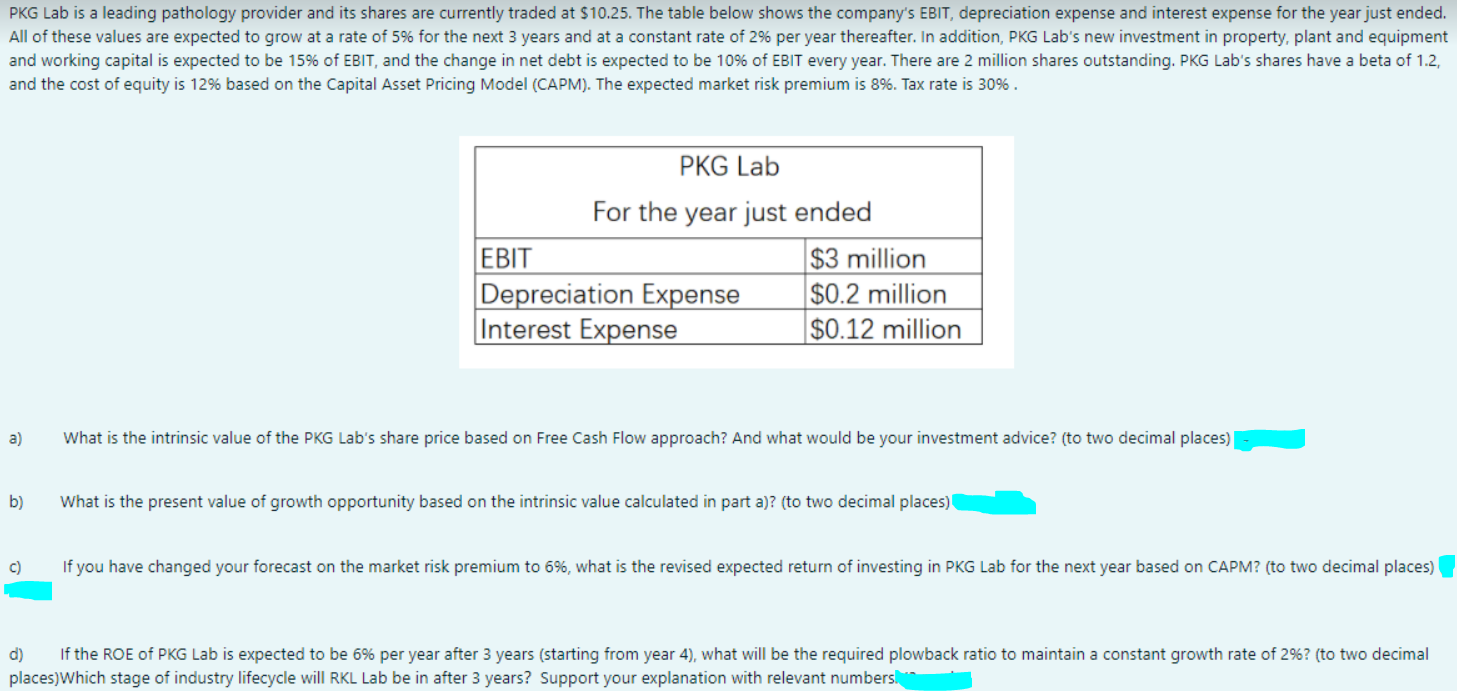

Write a JAVA program with a method called fit Switch, which takes an array of Strings as an argument. This method should then return a new array with every pair of elements from the original array swapped in position. If there is an odd number of elements, the last element should be left in its place. For example: // Input {"an", "even", "set", "test"); // Output {"even", "an", "test", "set"); // Input {"an", "odd", "set": //Output {"odd", "an", "set"}; PKG Lab is a leading pathology provider and its shares are currently traded at $10.25. The table below shows the company's EBIT, depreciation expense and interest expense for the year just ended. All of these values are expected to grow at a rate of 5% for the next 3 years and at a constant rate of 2% per year thereafter. In addition, PKG Lab's new investment in property, plant and equipment and working capital is expected to be 15% of EBIT, and the change in net debt is expected to be 10% of EBIT every year. There are 2 million shares outstanding. PKG Lab's shares have a beta of 1.2, and the cost of equity is 12% based on the Capital Asset Pricing Model (CAPM). The expected market risk premium is 8%. Tax rate is 30%. PKG Lab For the year just ended EBIT $3 million Depreciation Expense $0.2 million Interest Expense $0.12 million a) What is the intrinsic value of the PKG Lab's share price based on Free Cash Flow approach? And what would be your investment advice? (to two decimal places) b) What is the present value of growth opportunity based on the intrinsic value calculated in part a)? (to two decimal places) If you have changed your forecast on the market risk premium to 6%, what is the revised expected return of investing in PKG Lab for the next year based on CAPM? (to two decimal places) d) If the ROE of PKG Lab is expected to be 6% per year after 3 years (starting from year 4), what will be the required plowback ratio to maintain a constant growth rate of 2%? (to two decimal places)Which stage of industry lifecycle will RKL Lab be in after 3 years? Support your explanation with relevant numbers Write a JAVA program with a method called fit Switch, which takes an array of Strings as an argument. This method should then return a new array with every pair of elements from the original array swapped in position. If there is an odd number of elements, the last element should be left in its place. For example: // Input {"an", "even", "set", "test"); // Output {"even", "an", "test", "set"); // Input {"an", "odd", "set": //Output {"odd", "an", "set"}; PKG Lab is a leading pathology provider and its shares are currently traded at $10.25. The table below shows the company's EBIT, depreciation expense and interest expense for the year just ended. All of these values are expected to grow at a rate of 5% for the next 3 years and at a constant rate of 2% per year thereafter. In addition, PKG Lab's new investment in property, plant and equipment and working capital is expected to be 15% of EBIT, and the change in net debt is expected to be 10% of EBIT every year. There are 2 million shares outstanding. PKG Lab's shares have a beta of 1.2, and the cost of equity is 12% based on the Capital Asset Pricing Model (CAPM). The expected market risk premium is 8%. Tax rate is 30%. PKG Lab For the year just ended EBIT $3 million Depreciation Expense $0.2 million Interest Expense $0.12 million a) What is the intrinsic value of the PKG Lab's share price based on Free Cash Flow approach? And what would be your investment advice? (to two decimal places) b) What is the present value of growth opportunity based on the intrinsic value calculated in part a)? (to two decimal places) If you have changed your forecast on the market risk premium to 6%, what is the revised expected return of investing in PKG Lab for the next year based on CAPM? (to two decimal places) d) If the ROE of PKG Lab is expected to be 6% per year after 3 years (starting from year 4), what will be the required plowback ratio to maintain a constant growth rate of 2%? (to two decimal places)Which stage of industry lifecycle will RKL Lab be in after 3 years? Support your explanation with relevant numbers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts