Question: Write a reconciliation statement and conclusion of value based on the above facts: The subject property is 75 year old single-family residential home which originally

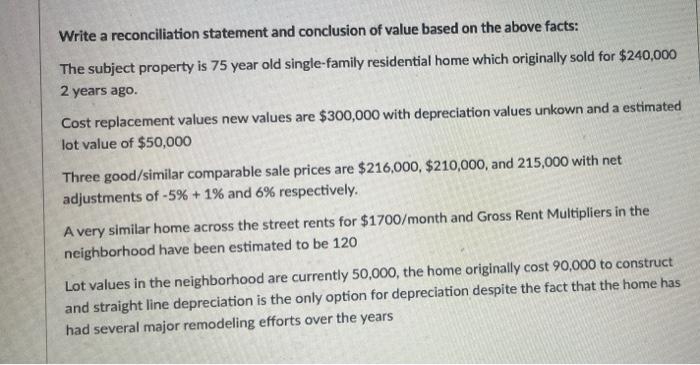

Write a reconciliation statement and conclusion of value based on the above facts: The subject property is 75 year old single-family residential home which originally sold for $240,000 2 years ago. Cost replacement values new values are $300,000 with depreciation values unkown and a estimated lot value of $50,000 Three good/similar comparable sale prices are $216,000, $210,000, and 215,000 with net adjustments of -5% + 1% and 6% respectively. A very similar home across the street rents for $1700/month and Gross Rent Multipliers in the neighborhood have been estimated to be 120 Lot values in the neighborhood are currently 50,000, the home originally cost 90,000 to construct and straight line depreciation is the only option for depreciation despite the fact that the home has had several major remodeling efforts over the years Write a reconciliation statement and conclusion of value based on the above facts: The subject property is 75 year old single-family residential home which originally sold for $240,000 2 years ago. Cost replacement values new values are $300,000 with depreciation values unkown and a estimated lot value of $50,000 Three good/similar comparable sale prices are $216,000, $210,000, and 215,000 with net adjustments of -5% + 1% and 6% respectively. A very similar home across the street rents for $1700/month and Gross Rent Multipliers in the neighborhood have been estimated to be 120 Lot values in the neighborhood are currently 50,000, the home originally cost 90,000 to construct and straight line depreciation is the only option for depreciation despite the fact that the home has had several major remodeling efforts over the years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts