Question: Write a stochastic search algorithm to solve the Start Oil Company problem from HW4, repeated here for convenience: Star Oil Company is considering five different

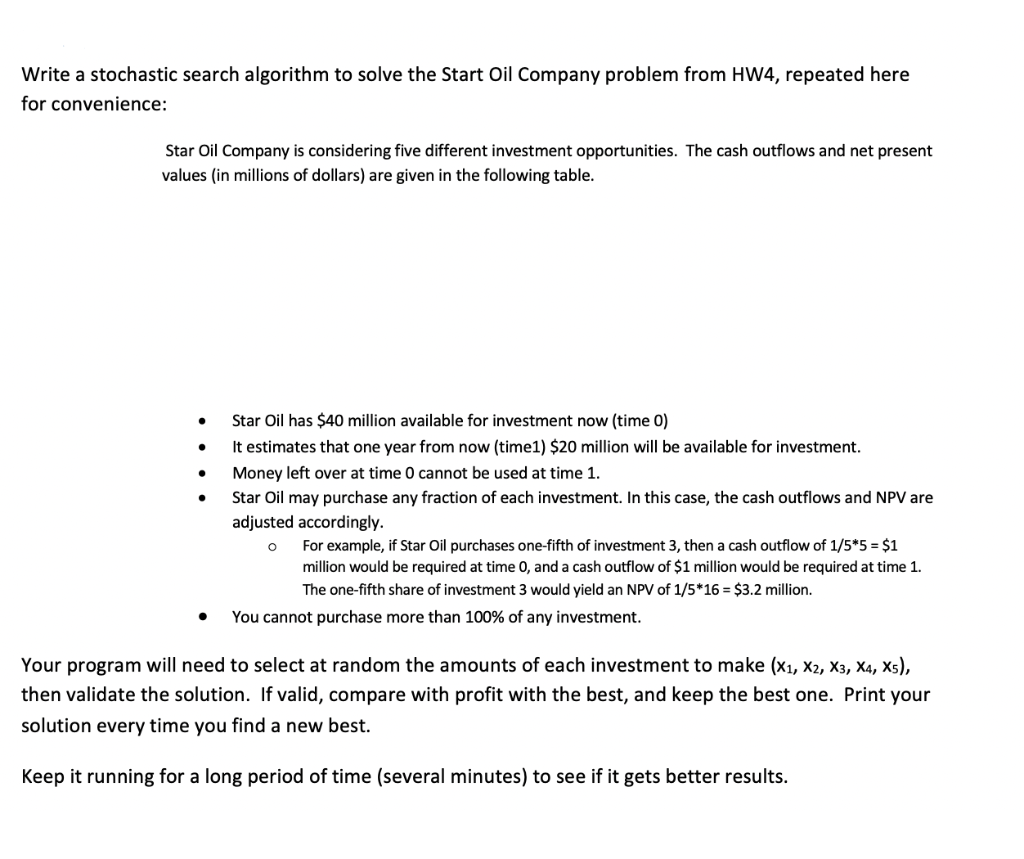

Write a stochastic search algorithm to solve the Start Oil Company problem from HW4, repeated here for convenience: Star Oil Company is considering five different investment opportunities. The cash outflows and net present values (in millions of dollars) are given in the following table. . . . Star Oil has $40 million available for investment now (time 0) It estimates that one year from now (time1) $20 million will be available for investment. Money left over at time 0 cannot be used at time 1. Star Oil may purchase any fraction of each investment. In this case, the cash outflows and NPV are adjusted accordingly. For example, if Star Oil purchases one-fifth of investment 3, then a cash outflow of 1/5*5 = $1 million would be required at time 0, and a cash outflow of $1 million would be required at time 1. The one-fifth share of investment 3 would yield an NPV of 1/5*16 = $3.2 million. You cannot purchase more than 100% of any investment. Your program will need to select at random the amounts of each investment to make (X1, X2, X3, X4, X5), then validate the solution. If valid, compare with profit with the best, and keep the best one. Print your solution every time you find a new best. Keep it running for a long period of time (several minutes) to see if it gets better results. Write a stochastic search algorithm to solve the Start Oil Company problem from HW4, repeated here for convenience: Star Oil Company is considering five different investment opportunities. The cash outflows and net present values (in millions of dollars) are given in the following table. . . . Star Oil has $40 million available for investment now (time 0) It estimates that one year from now (time1) $20 million will be available for investment. Money left over at time 0 cannot be used at time 1. Star Oil may purchase any fraction of each investment. In this case, the cash outflows and NPV are adjusted accordingly. For example, if Star Oil purchases one-fifth of investment 3, then a cash outflow of 1/5*5 = $1 million would be required at time 0, and a cash outflow of $1 million would be required at time 1. The one-fifth share of investment 3 would yield an NPV of 1/5*16 = $3.2 million. You cannot purchase more than 100% of any investment. Your program will need to select at random the amounts of each investment to make (X1, X2, X3, X4, X5), then validate the solution. If valid, compare with profit with the best, and keep the best one. Print your solution every time you find a new best. Keep it running for a long period of time (several minutes) to see if it gets better results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts