Question: Write a tax research memo using this information. Only need to include facts, issues, conlcusion, and analysis. TAX RESEARCH MEMO #2 CASE INFORMATION - AC312

Write a tax research memo using this information. Only need to include facts, issues, conlcusion, and analysis.

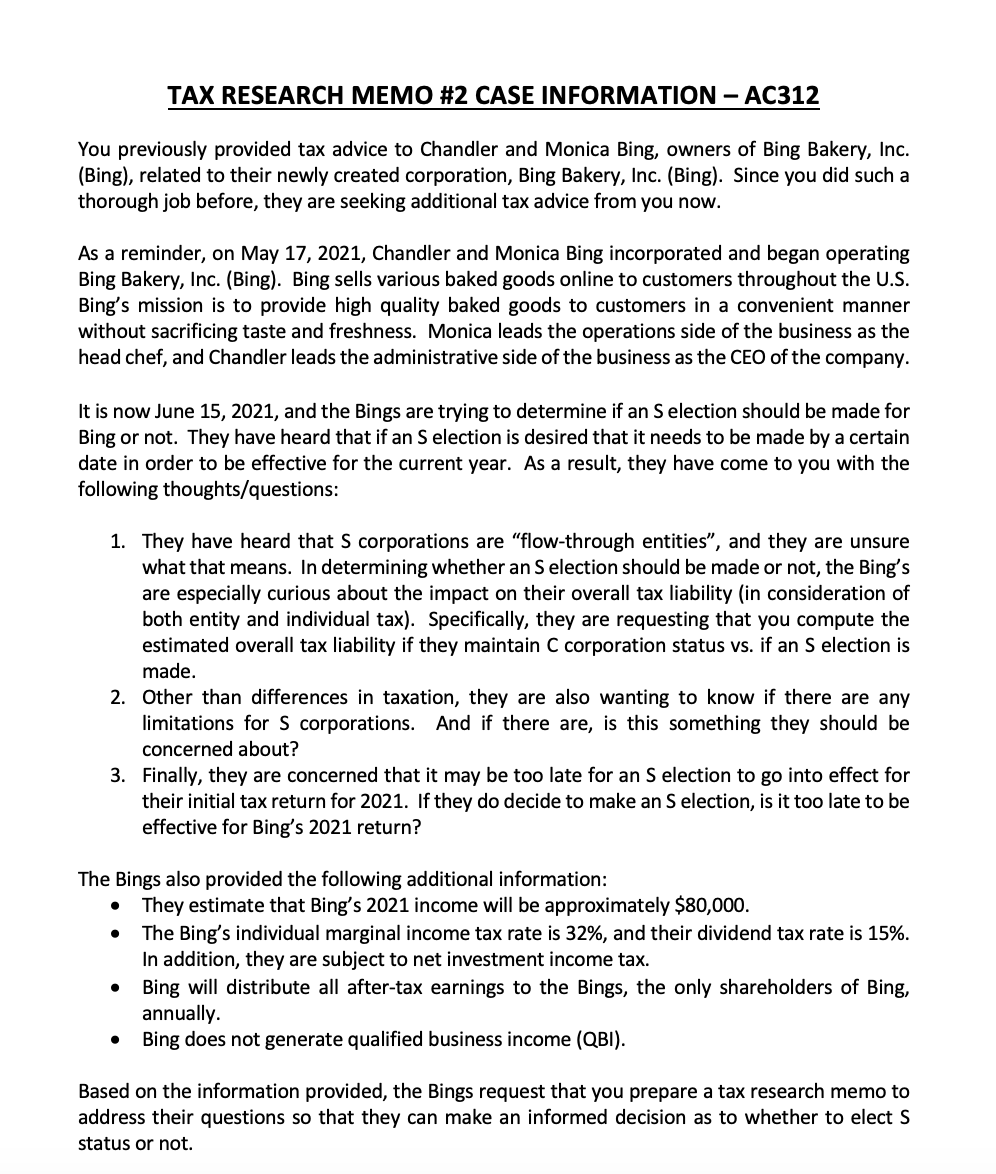

TAX RESEARCH MEMO \#2 CASE INFORMATION - AC312 You previously provided tax advice to Chandler and Monica Bing, owners of Bing Bakery, Inc. (Bing), related to their newly created corporation, Bing Bakery, Inc. (Bing). Since you did such a thorough job before, they are seeking additional tax advice from you now. As a reminder, on May 17, 2021, Chandler and Monica Bing incorporated and began operating Bing Bakery, Inc. (Bing). Bing sells various baked goods online to customers throughout the U.S. Bing's mission is to provide high quality baked goods to customers in a convenient manner without sacrificing taste and freshness. Monica leads the operations side of the business as the head chef, and Chandler leads the administrative side of the business as the CEO of the company. It is now June 15, 2021, and the Bings are trying to determine if an S election should be made for Bing or not. They have heard that if an S election is desired that it needs to be made by a certain date in order to be effective for the current year. As a result, they have come to you with the following thoughts/questions: 1. They have heard that S corporations are "flow-through entities", and they are unsure what that means. In determining whether an S election should be made or not, the Bing's are especially curious about the impact on their overall tax liability (in consideration of both entity and individual tax). Specifically, they are requesting that you compute the estimated overall tax liability if they maintain C corporation status vs. if an S election is made. 2. Other than differences in taxation, they are also wanting to know if there are any limitations for S corporations. And if there are, is this something they should be concerned about? 3. Finally, they are concerned that it may be too late for an S election to go into effect for their initial tax return for 2021. If they do decide to make an S election, is it too late to be effective for Bing's 2021 return? The Bings also provided the following additional information: - They estimate that Bing's 2021 income will be approximately $80,000. - The Bing's individual marginal income tax rate is 32%, and their dividend tax rate is 15%. In addition, they are subject to net investment income tax. - Bing will distribute all after-tax earnings to the Bings, the only shareholders of Bing, annually. - Bing does not generate qualified business income (QBI). Based on the information provided, the Bings request that you prepare a tax research memo to address their questions so that they can make an informed decision as to whether to elect S status or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts