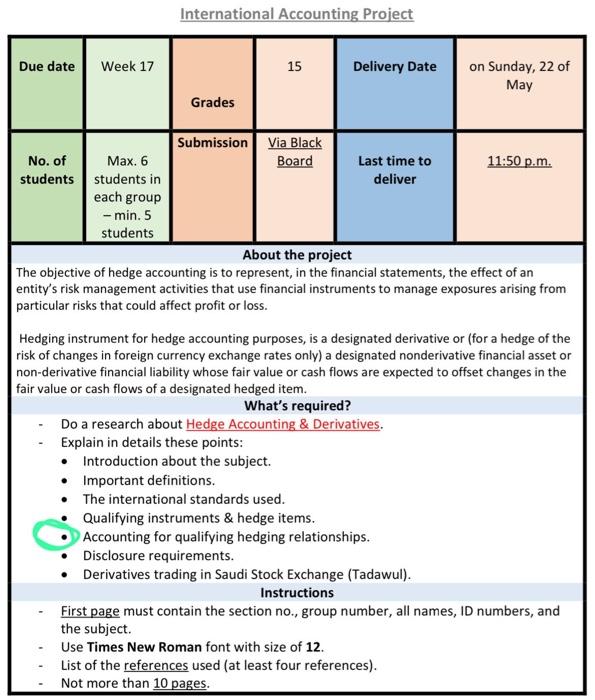

Question: Write about The Accounting for qualifying hedging relationships. This is my part of the research shown in the picture International Accounting Project Due date Week

International Accounting Project Due date Week 17 15 Delivery Date on Sunday, 22 of May Grades Submission Via Black No. of Max. 6 Board Last time to 11:50 p.m. students students in deliver each group - min. 5 students About the project The objective of hedge accounting is to represent in the financial statements, the effect of an entity's risk management activities that use financial instruments to manage exposures arising from particular risks that could affect profit or loss. Hedging instrument for hedge accounting purposes, is a designated derivative or (for a hedge of the risk of changes in foreign currency exchange rates only) a designated nonderivative financial asset or non-derivative financial liability whose fair value or cash flows are expected to offset changes in the fair value or cash flows of a designated hedged item. What's required? Do a research about Hedge Accounting & Derivatives. Explain in details these points: Introduction about the subject. Important definitions. The international standards used. Qualifying instruments & hedge items. Accounting for qualifying hedging relationships. Disclosure requirements. Derivatives trading in Saudi Stock Exchange (Tadawul). Instructions First page must contain the section no., group number, all names, ID numbers, and the subject. Use Times New Roman font with size of 12. List of the references used (at least four references). Not more than 10 pages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts