Question: Write all the formula for example inventory turnover ratio= COGS/Inventory. Do it, continue the rest. And compare individually which is better. Need one line

Write all the formula for example "inventory turnover ratio= COGS/Inventory." Do it, continue the rest.

And compare individually which is better. Need one line explanation.

After find all compare, you have to conclude in one line in one statement, which year performance which would better.

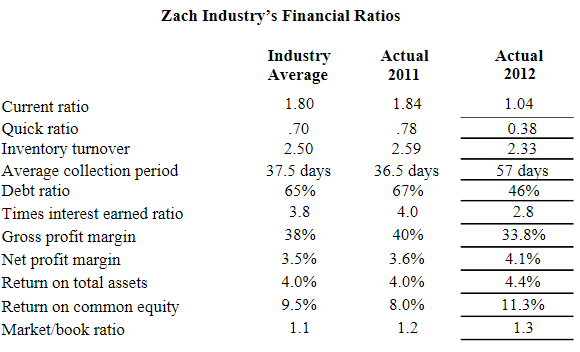

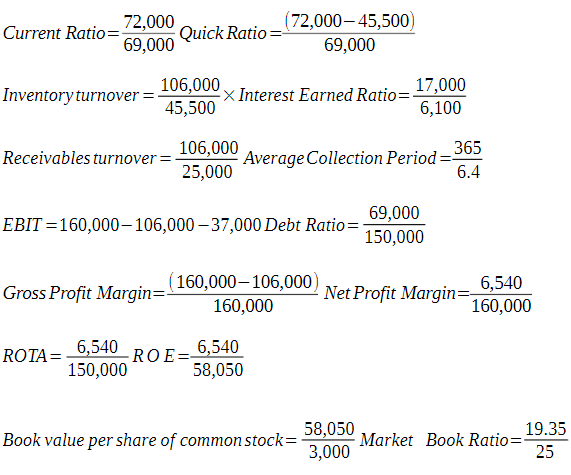

Zach Industry's Financial Ratios Actual 2012 Current ratio Quick ratio Inventory turnover Average collection period Debt ratio Times interest earned ratio Gross profit margin Net profit margin Return on total assets Return on common equity Market/book ratio Industry Average 1.80 .70 2.50 37.5 days 65% 3.8 38% 3.5% 4.0% 9.5% 1.1 Actual 2011 1.84 .78 2.59 36.5 days 67% 4.0 40% 3.6% 4.0% 8.0% 1.2 1.04 0.38 2.33 57 days 46% 2.8 33.8% 4.1% 4.4% 11.3% 1.3 Current Ratio= 72,000 Quick Ratio 69,000 (72,00045,500 69,000 106,000 17,000 X Interest Earned Ratio=. Inventory turnover = 45,500 6,100 Receivables turnover = 106,000 Average Collection Period= 365 25,000 6.4 69,000 EBIT =160,000-106,000-37,000 Debt Ratio= 150,000 (160,000-106,000 Gross Profit Margin= 160,000 6,540 Net Profit Margin= 160,000 ROTA= 6,540 ROE= 6,540 150,000 58,050 58,050 19.35 Book value per share of common stock= Market Book Ratio=- 3,000 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts