Question: write clearly, all steps please. 1 Amazon stock has a beta of 1.8 to the market index factor, a beta of 1.9 to the size

write clearly, all steps please.

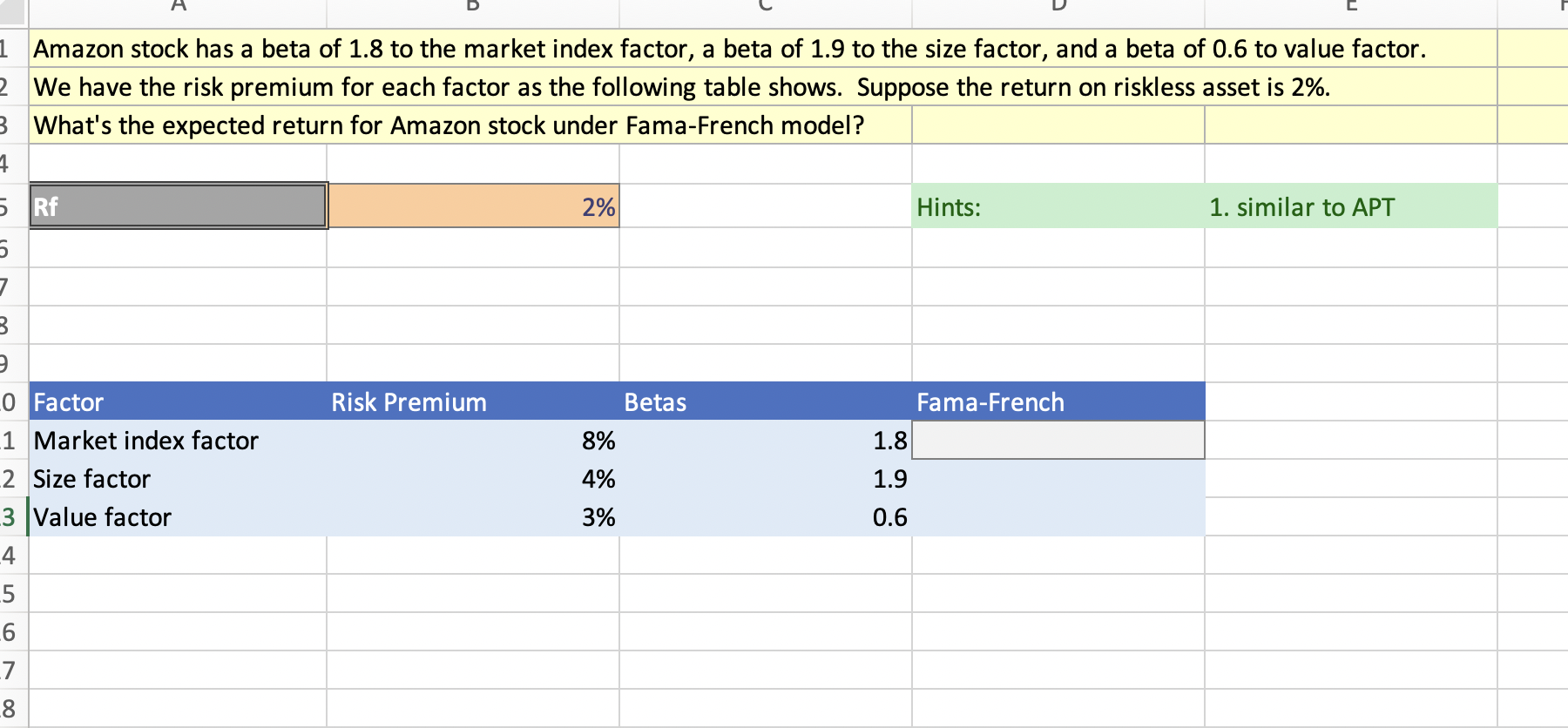

1 Amazon stock has a beta of 1.8 to the market index factor, a beta of 1.9 to the size factor, and a beta of 0.6 to value factor. We have the risk premium for each factor as the following table shows. Suppose the return on riskless asset is 2%. What's the expected return for Amazon stock under Fama-French model? \begin{tabular}{|l|l} \hline \hline Rf \\ \hline \hline \end{tabular} 2% Hints: 1. similar to APT \begin{tabular}{lllll|} 0 & Risk Premium & Betas & Fama-French \\ 1 & Pactor & 8% & 1.8 & \\ 1 & Market index factor & 4% & 1.9 \\ 2 Size factor & 3% & 0.6 & \\ 3 & Value factor & 3% & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts