Question: write clearly, all steps please. - Suppose the IBM stock's covariance with the market returns is 0.86, and the variance of the returns on the

write clearly, all steps please.

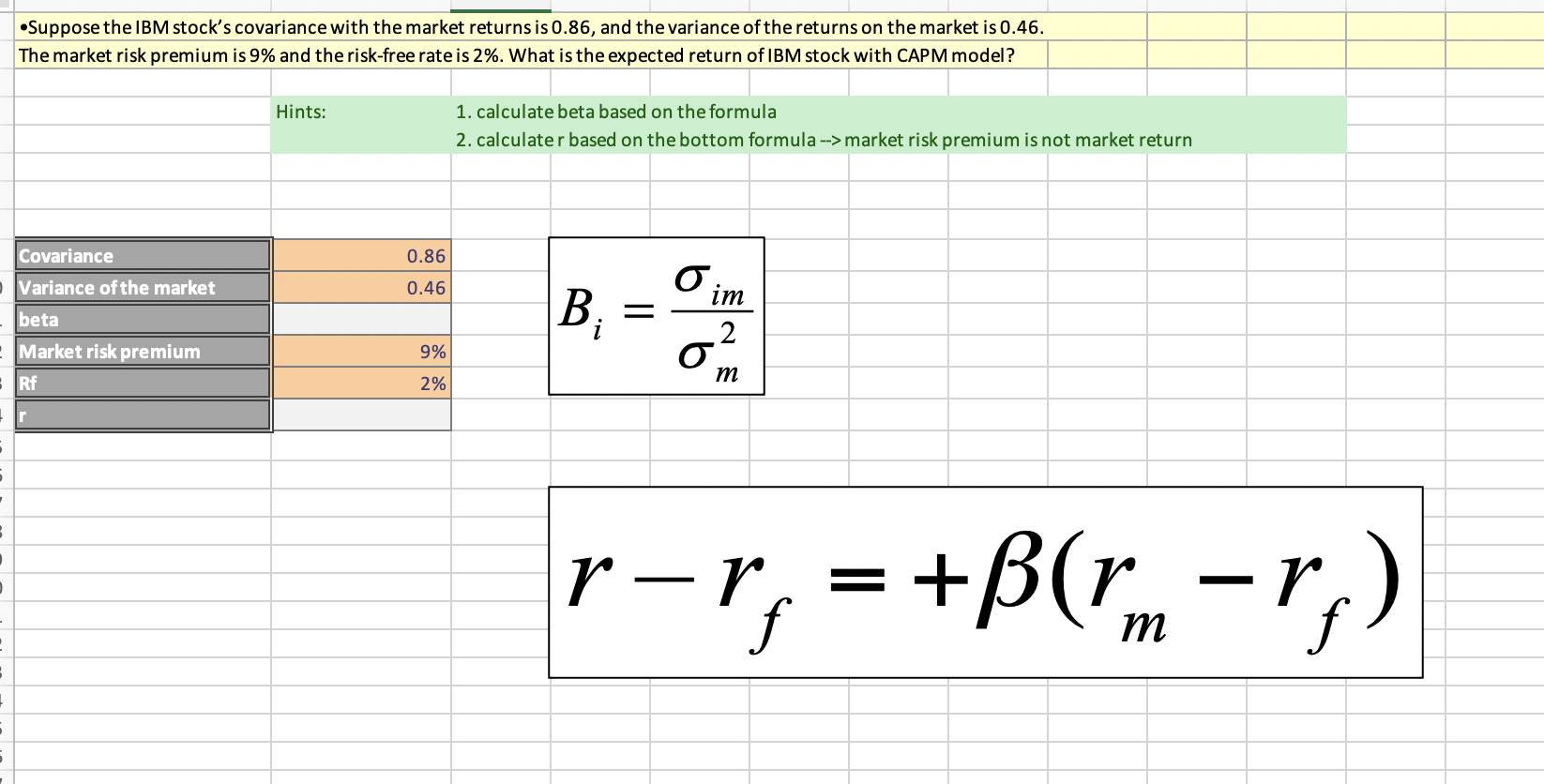

- Suppose the IBM stock's covariance with the market returns is 0.86, and the variance of the returns on the market is 0.46 e market risk premium is 9% and the risk-free rate is 2%. What is the expected return of IBM stock with CAPM model? 1. calculate beta based on the formula 2. calculate r based on the bottom formula - market risk premium is not market return Bi=m2im rrf=+(rmrf)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts