Question: write down a common -size statementandprovide ratios using the attached financial data. Do the following ratios: 1. working capital 2. current ratio 3. receivable turnover

write down a common -size statementandprovide ratios using the attached financial data. Do the following ratios:

1. working capital

2. current ratio

3. receivable turnover

4. collection period (age of receivables)

5. debt ratio

* round offfinal answer to 2 decimal places.present your statement and solution properly

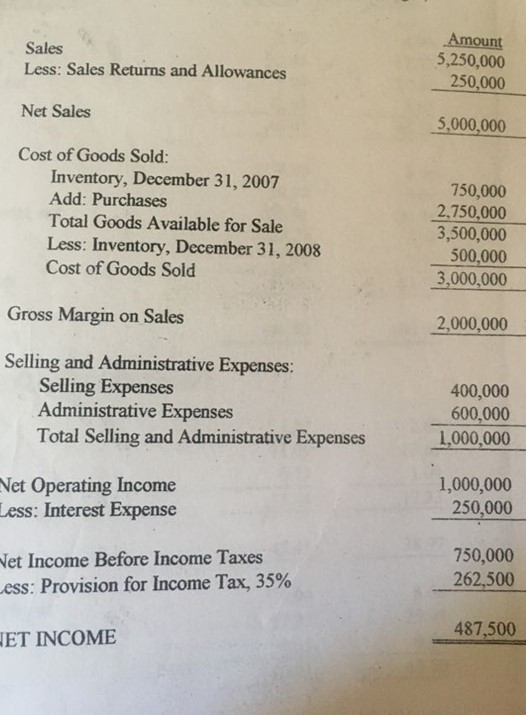

PRT COMPANY

INCOME STATEMENT

FOR YEAR ENDED DECEMBER 31, 2008

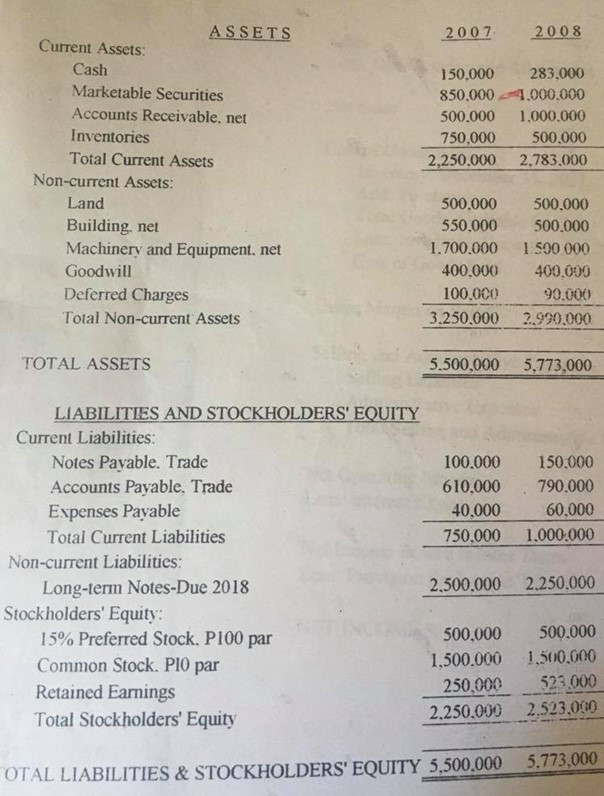

Amount Sales 5,250,000 Less: Sales Returns and Allowances 250,000 Net Sales 5,000,000 Cost of Goods Sold: Inventory, December 31, 2007 750,000 Add: Purchases 2,750,000 Total Goods Available for Sale 3,500,000 Less: Inventory, December 31, 2008 500,000 Cost of Goods Sold 3,000,000 Gross Margin on Sales 2,000,000 Selling and Administrative Expenses: Selling Expenses 400,000 Administrative Expenses 600,000 Total Selling and Administrative Expenses 1,000,000 Net Operating Income 1,000,000 ess: Interest Expense 250,000 Net Income Before Income Taxes 750,000 ess: Provision for Income Tax, 35% 262,500 487,500 JET INCOMEASSETS 2007 2008 Current Assets: Cash 150.000 283.000 Marketable Securities 850.000 - 1.000.000 Accounts Receivable. net 500.000 1,000.000 Inventories 750,000 500.000 Total Current Assets 2,250,000 2.783.000 Non-current Assets: Land 500.000 500.000 Building net 550,000 500.000 Machinery and Equipment. net 1.700.000 1 500 000 Goodwill 400.000 400.000 Deferred Charges 100.000 90.000 Total Non-current Assets 3.250.000 2.990.000 TOTAL ASSETS 5.500,000 5,773,000 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Notes Payable. Trade 100.000 150.000 Accounts Payable, Trade 610.000 790.000 Expenses Payable 40.000 60.000 Total Current Liabilities 750.000 1.000:000 Non-current Liabilities: Long-term Notes-Due 2018 2,500.000 2.250.000 Stockholders' Equity: 15% Preferred Stock. P100 par 500,000 500.000 Common Stock. PIO par 1,500.000 1.500.000 Retained Earnings 250.000 523,000 Total Stockholders' Equity 2.250.000 2.523.000 OTAL LIABILITIES & STOCKHOLDERS' EQUITY 5,500.000 5.773,000