Question: Write down the formula that is used to calculate the yield to maturity on a 20-year los coupon bond with $1,000 face value that sells

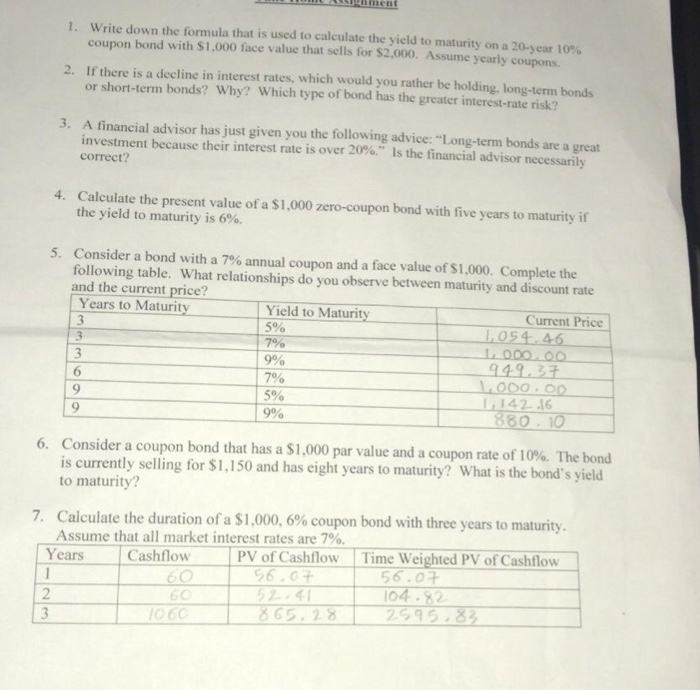

Write down the formula that is used to calculate the yield to maturity on a 20-year los coupon bond with $1,000 face value that sells for $2,000. Assume yearly coupons 1 If there is a decline in interest rates, which would you rather be holding, long-term bonds or short-term bonds? Why? Which type of bond has the greater interest-rate risk? 2. 3. A financial advisor has just given you the following advice: "Long-term bonds are a great investment because their interest rate is over 20% correct? Is the financial advisor necessarily 4. Calculate the present value of a $1,000 zero-coupon bond with five years to maturity if 5. Consider a bond with a 7% annual coupon and a face value of $1,000. Complete the Yield to Maturity the yield to maturity is 6%. following table. What relationships do you observe between maturity and discount rate and the current price? Years to Maturity Current Price 5% L054 46 6 9 7% 5% 900 9492 000 Op 1142 16 880 10 Consider a coupon bond that has a $1,000 par value and a coupon rate of 10%. The bond is currently selling for $1,150 and has eight years to maturity? What is the bond's yield to maturity? 6. 7. Calculate the duration of a $1,000, 6% coupon bond with three years to maturity. YearsCashflow PV of Cashflow Time Weighted PV of Cashflow 2 Assume that all market interest rates are 7%. 6,0T 24 56.0 60 60

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts