Question: Write entry R and entry N separately People Co. acquired 80% of Steeple Co.'s common stock for $10,000,000 in cash on Jan. 2, 20x1. At

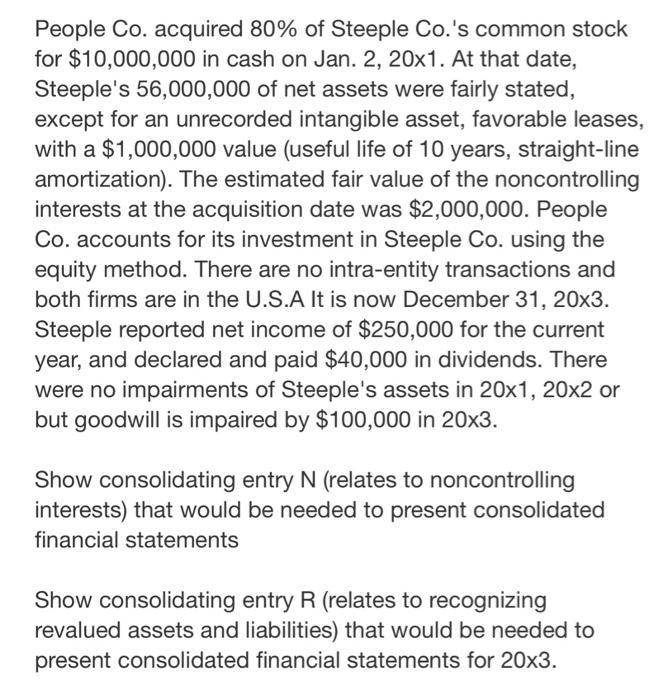

People Co. acquired 80% of Steeple Co.'s common stock for $10,000,000 in cash on Jan. 2, 20x1. At that date, Steeple's 56,000,000 of net assets were fairly stated, except for an unrecorded intangible asset, favorable leases, with a $1,000,000 value (useful life of 10 years, straight-line amortization). The estimated fair value of the noncontrolling interests at the acquisition date was $2,000,000. People Co. accounts for its investment in Steeple Co. using the equity method. There are no intra-entity transactions and both firms are in the U.S.A It is now December 31, 20x3. Steeple reported net income of $250,000 for the current year, and declared and paid $40,000 in dividends. There were no impairments of Steeple's assets in 20x1, 20x2 or but goodwill is impaired by $100,000 in 20x3. Show consolidating entry N (relates to noncontrolling interests) that would be needed to present consolidated financial statements Show consolidating entry R (relates to recognizing revalued assets and liabilities) that would be needed to present consolidated financial statements for 20x3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts