Question: Write in C++ You have been asked to write a program to calculate income tax for a local Certified Public Accountant (CPA) Your program must

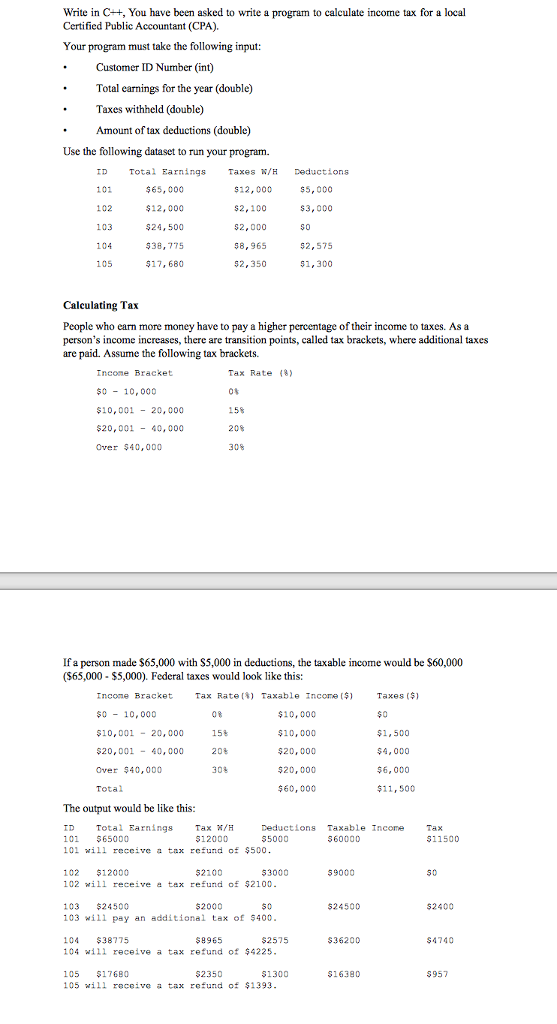

Write in C++ You have been asked to write a program to calculate income tax for a local Certified Public Accountant (CPA) Your program must take the following input: Customer ID Number (int) Total earnings for the year (double) Taxes withheld (double) Amount of tax deductions (double) Use the following dataset to run your program ID Total 101 102 103 104 105 arnings Tes W/H Deductions $65, 000 $12,000 $24,500 38,775 $17, 680 $12, 000 $2,100 $2,000 $8,965 $2,350 $5, 000 $3,000 s0 $2,575 $1,300 Calculating Tax People who earn more money have to pay a higher percentage of their income to taxes. As a person's income increases, there are transition points, called tax brackets, where additional taxes are paid. Assume the following tax brackets. Tax Rate 8) Incone Bracket $0 10, 000 $10,001- 20,000 $20,001-40,000 Over $40,000 158 208 30% If a person made $65,000 with S5,000 in deductions, the taxable income would be $60,000 ($65,000 $5,000). Federal taxes would look like this: Tax Rate[ Income($) Taxes($) $0 $1,500 $4,000 $6, 000 $11,500 Taxable Income Bracket $0 10, 000 $10,001-20,000 $20,001-40,000 Over $40,000 Total $10,000 $10,000 20,000 $20,000 60,000 08 158 30% The output would be like this ID Total Earnings 101 565000 101 will receive a tax refund ot $500 Tax H Deductions Taxable Income 55000 Tax 511500 $12000 360000 102 $12000 102 will receive a tex refund of $2100 $2100 3000 59000 50 $2000 50 $24500 $2400 103 $24500 103 wil1 pay an additional tax of $400 $9965 2575 $36200 $4740 104 $38775 104 wil1 receive a tax refund of $4225 $2350 $1300 316380 S957 105 $176B0 1.05 will roceive tax refund of $1393

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts