Question: write me a mathmateical code using matlab and excel Case Study: Optimization of Currency Exchange Operations *Background:* The manager of a currency exchange company is

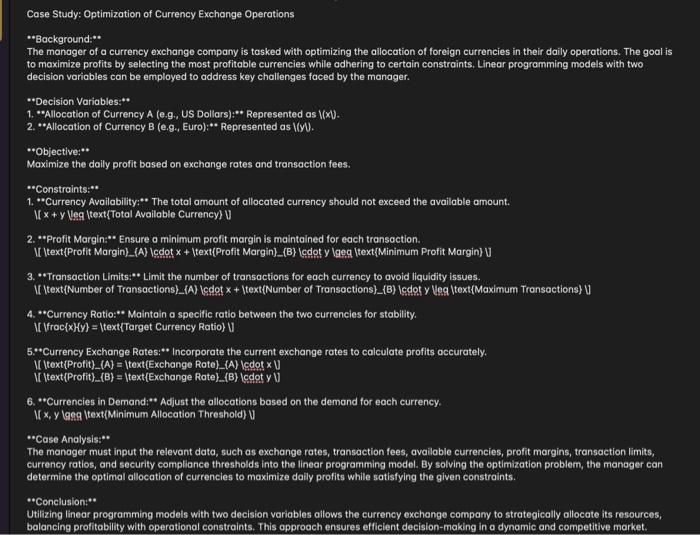

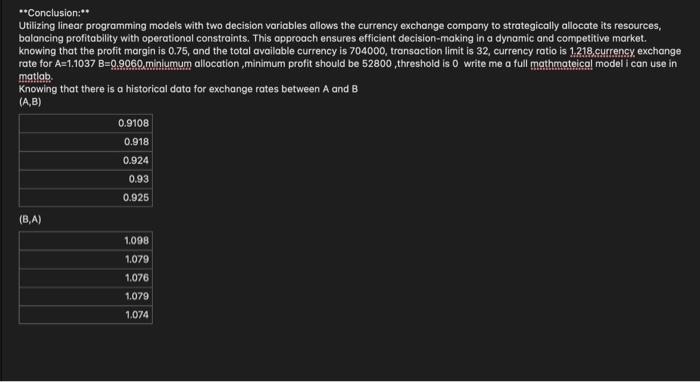

Case Study: Optimization of Currency Exchange Operations "*Background:"* The manager of a currency exchange company is tasked with optimizing the allocation of foreign currencies in their daily operations. The goal is to maximize profits by selecting the most profitable currencies while adhering to certain constraints. Linear programming models with two decision variables can be employed to address key challenges faced by the manager. "*Decision Variables:"* 1. "*Allocation of Currency A (e.g., US Dollars):"* Represented as V(x). 2. "Allocation of Currency B (e.g., Euro):"* Represented as (ly). **Objective:"* Maximize the daily profit based on exchange rates and transaction fees. "*Constraints:"* 1. "Currency Availability:" The total amount of allocated currency should not exceed the available amount. [ x+y [leg Itext[Total Available Currency] U 2. "*Profit Margin:*" Ensure a minimum profit margin is maintained for each transaction. 3. "*Transaction Limits:"* Limit the number of transactions for each currency to avoid liquidity issues. 4. "Currency Ratio:" Maintain a specific ratio between the two currencies for stability. If (frac {x}{y}= |text (Target Currency Ratio\} U 5."Currency Exchange Rates:"* Incorporate the current exchange rates to calculate profits accurately. 6. "Currencies in Demand:"* Adjust the allocations based on the demand for each currency. If x,y lagg (text(Minimum Allocation Threshold) U "Case Analysis:** The manager must input the relevant data, such as exchange rates, transaction fees, available currencies, profit margins, transaction limits, currency ratios, and security compliance thresholds into the linear programming model. By solving the optimization problem, the manager can determine the optimal allocation of currencies to maximize dally profits while satisfying the given constraints. *"Conclusion:"* Utilizing linear programming models with two decision variables allows the currency exchange company to strategically allocate its resources, balancing profitability with operational constraints. This approach ensures efficient decision-making in a dynamic and competitive market. "Conclusion:" Utilizing linear programming models with two decision variables allows the currency exchange company to strategically allocate its resources, balancing profitability with operational constraints. This approach ensures efficient decision-making in a dynamic and competitive market. knowing that the profit margin is 0.75 , and the total available currency is 704000 , transaction limit is 32 , currency ratio is 1.218 ,currency exchange rate for A=1.1037B=0.9060 minlumum allocation , minimum profit should be 52800 , threshold is 0 write me a full mgthmoteicol model ican use in matlab. Knowing that there is a historical data for exchange rates between A and B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts