Question: Write off Brown's long outstanding uncollected April Invoice using the direct write off method. The write off was for the $315 (Apr 2 invoice),

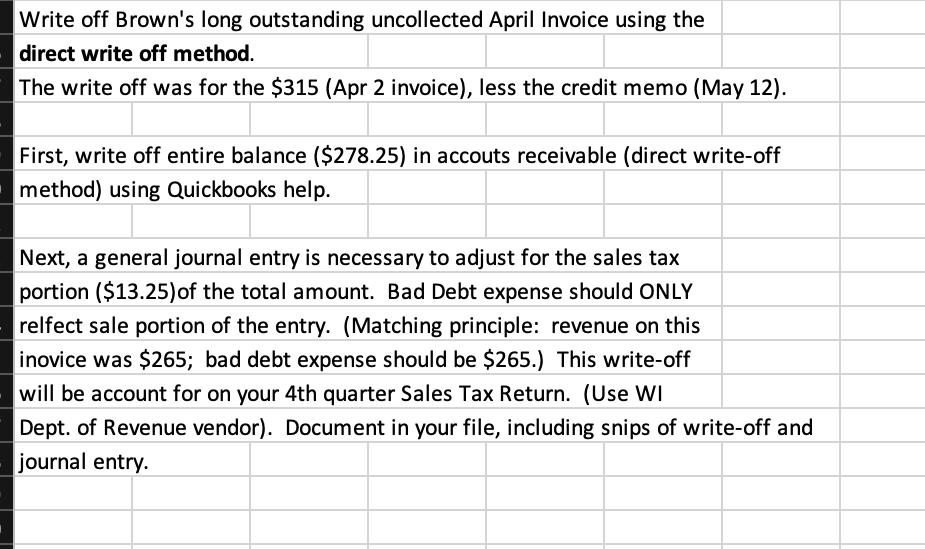

Write off Brown's long outstanding uncollected April Invoice using the direct write off method. The write off was for the $315 (Apr 2 invoice), less the credit memo (May 12). First, write off entire balance ($278.25) in accouts receivable (direct write-off method) using Quickbooks help. Next, a general journal entry is necessary to adjust for the sales tax portion ($13.25) of the total amount. Bad Debt expense should ONLY relfect sale portion of the entry. (Matching principle: revenue on this inovice was $265; bad debt expense should be $265.) This write-off will be account for on your 4th quarter Sales Tax Return. (Use WI Dept. of Revenue vendor). Document in your file, including snips of write-off and journal entry.

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Answer 1 General guidance The answer provided below has been developed in a clear step by step manne... View full answer

Get step-by-step solutions from verified subject matter experts