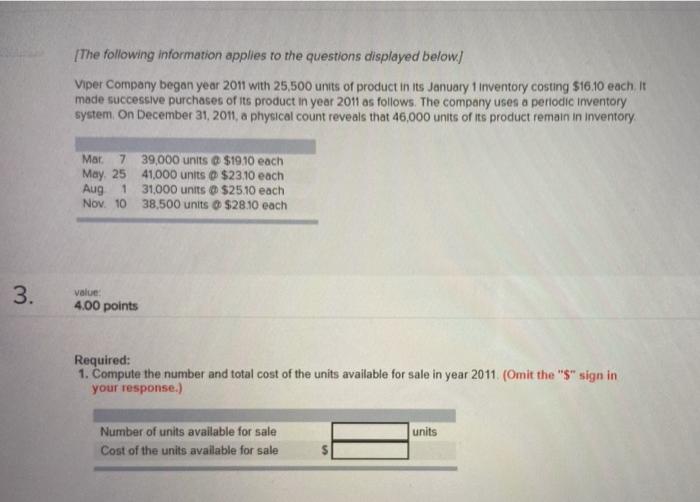

Question: write step by step solution please. thx [The following information applies to the questions displayed below) Viper Company began year 2011 with 25,500 units of

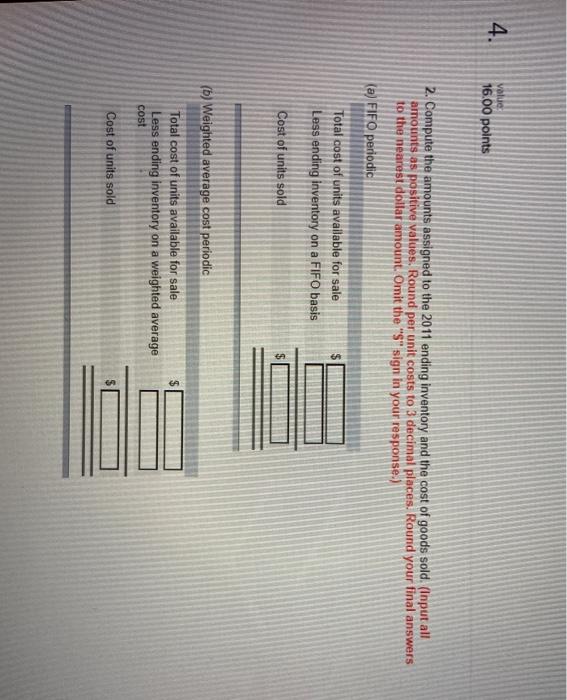

[The following information applies to the questions displayed below) Viper Company began year 2011 with 25,500 units of product in its January 1 inventory costing $16.10 each It made successive purchases of its product in year 2011 as follows. The company uses a periodic inventory system on December 31, 2011, a physical count reveals that 46,000 units of its product remain in Inventory Mar 7 39,000 units $1910 each May 25 41,000 units $23.10 each Aug 1 31,000 units $2510 each Nov. 10 38,500 units $28.10 each 3. value: 4.00 points Required: 1. Compute the number and total cost of the units available for sale in year 2011 (Omit the "S" sign in your response.) units Number of units available for sale Cost of the units available for sale 4. value 16.00 points 2. Compute the amounts assigned to the 2011 ending inventory and the cost of goods sold. (Input all amounts as positive values. Round per unit costs to 3 decimal places. Round your final answers to the nearest dollar amount. Omit the "S" sign in your response.) (a) FIFO periodic Total cost of units available for sale Less ending inventory on a FIFO basis Cost of units sold (b) Weighted average cost periodic $ Total cost of units available for sale Less ending inventory on a weighted average cost Cost of units sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts