Question: The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be

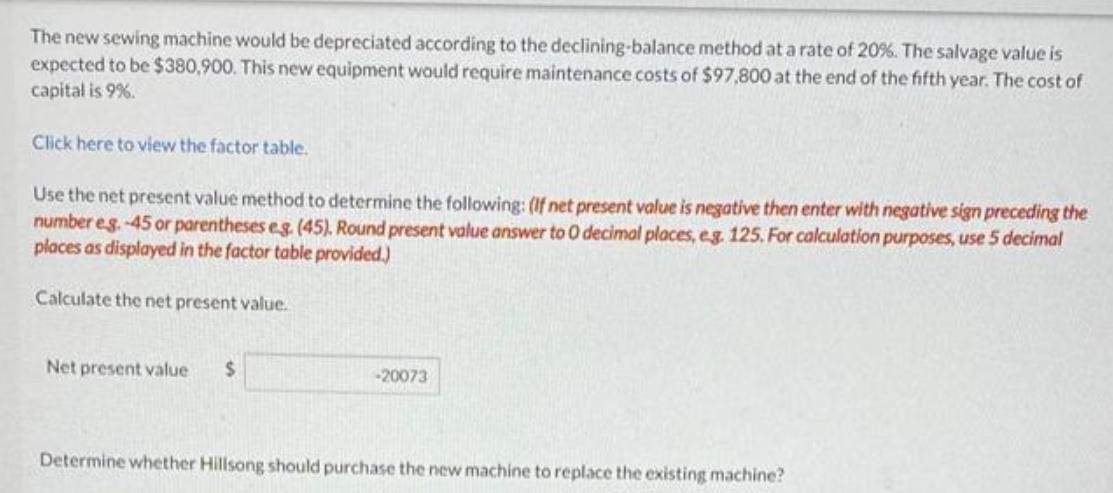

The new sewing machine would be depreciated according to the declining-balance method at a rate of 20%. The salvage value is expected to be $380,900. This new equipment would require maintenance costs of $97,800 at the end of the fifth year. The cost of capital is 9%. Click here to view the factor table. Use the net present value method to determine the following: (If net present value is negative then enter with negative sign preceding the number eg.-45 or parentheses eg. (45), Round present value answer to 0 decimal places, e.g. 125. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Calculate the net present value. Net present value $ -20073 Determine whether Hillsong should purchase the new machine to replace the existing machine?

Step by Step Solution

There are 3 Steps involved in it

The answer provided below has been developed in a clear step by step manner ... View full answer

Get step-by-step solutions from verified subject matter experts