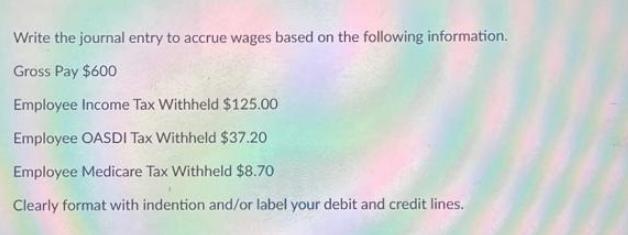

Question: Write the journal entry to accrue wages based on the following information. Gross Pay $600 Employee Income Tax Withheld $125.00 Employee OASDI Tax Withheld

Write the journal entry to accrue wages based on the following information. Gross Pay $600 Employee Income Tax Withheld $125.00 Employee OASDI Tax Withheld $37.20 Employee Medicare Tax Withheld $8.70 Clearly format with indention and/or label your debit and credit lines.

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Journal Entry to Accrue Wages Date Account Debit Credit Date ... View full answer

Get step-by-step solutions from verified subject matter experts