Question: Write the Objective Function as well as list the Constraints You are the fund manager for the Virginia Retirement System (VRS) which manages the pensions

Write the Objective Function as well as list the Constraints

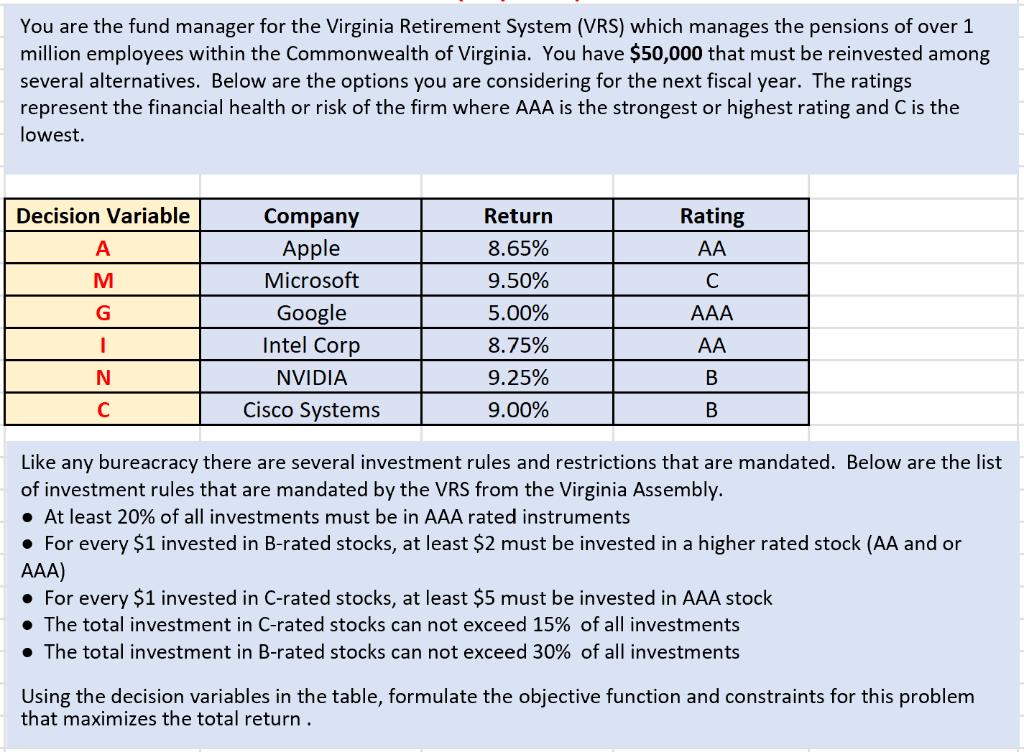

You are the fund manager for the Virginia Retirement System (VRS) which manages the pensions of over 1 million employees within the Commonwealth of Virginia. You have $50,000 that must be reinvested among several alternatives. Below are the options you are considering for the next fiscal year. The ratings represent the financial health or risk of the firm where AAA is the strongest or highest rating and C is the lowest. Decision Variable A M G I N C Company Apple Microsoft Google Intel Corp NVIDIA Cisco Systems Return 8.65% 9.50% 5.00% 8.75% 9.25% 9.00% Rating AA C AAA AA B B Like any bureacracy there are several investment rules and restrictions that are mandated. Below are the list of investment rules that are mandated by the VRS from the Virginia Assembly. At least 20% of all investments must be in AAA rated instruments For every $1 invested in B-rated stocks, at least $2 must be invested in a higher rated stock (AA and or AAA) For every $1 invested in C-rated stocks, at least $5 must be invested in AAA stock . The total investment in C-rated stocks can not exceed 15% of all investments The total investment in B-rated stocks can not exceed 30% of all investments Using the decision variables in the table, formulate the objective function and constraints for this problem that maximizes the total return.

Step by Step Solution

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Objective Function Maximize the total return on investment Lets define the decision variables A Inve... View full answer

Get step-by-step solutions from verified subject matter experts