Question: Write your own binomial American exercise program. Then evaluate the American call price and delta to 2 decimal places for a stock with S=50,

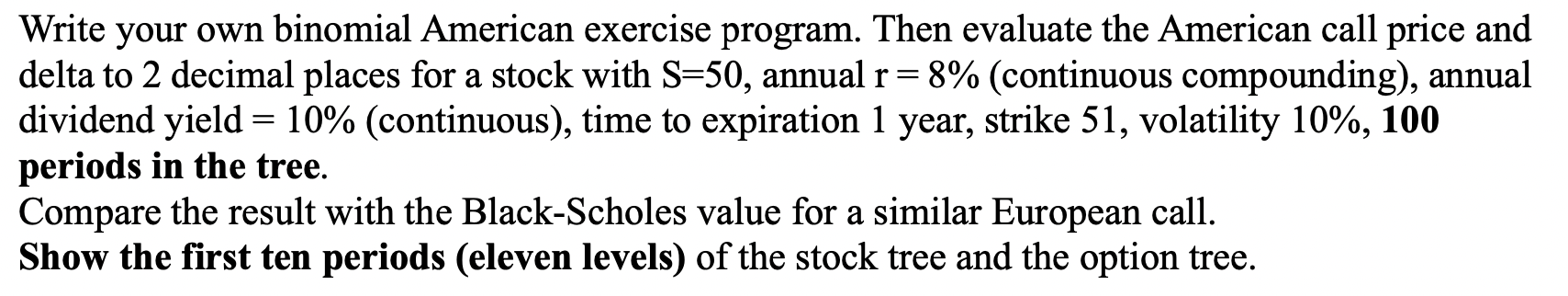

Write your own binomial American exercise program. Then evaluate the American call price and delta to 2 decimal places for a stock with S=50, annual r = 8% (continuous compounding), annual dividend yield = 10% (continuous), time to expiration 1 year, strike 51, volatility 10%, 100 periods in the tree. Compare the result with the Black-Scholes value for a similar European call. Show the first ten periods (eleven levels) of the stock tree and the option tree.

Step by Step Solution

There are 3 Steps involved in it

Heres the Python code to implement the binomial American exercise program and evaluate the American call price and delta python import math import numpy as np def binomialamericancallS K r q sigma T n ... View full answer

Get step-by-step solutions from verified subject matter experts