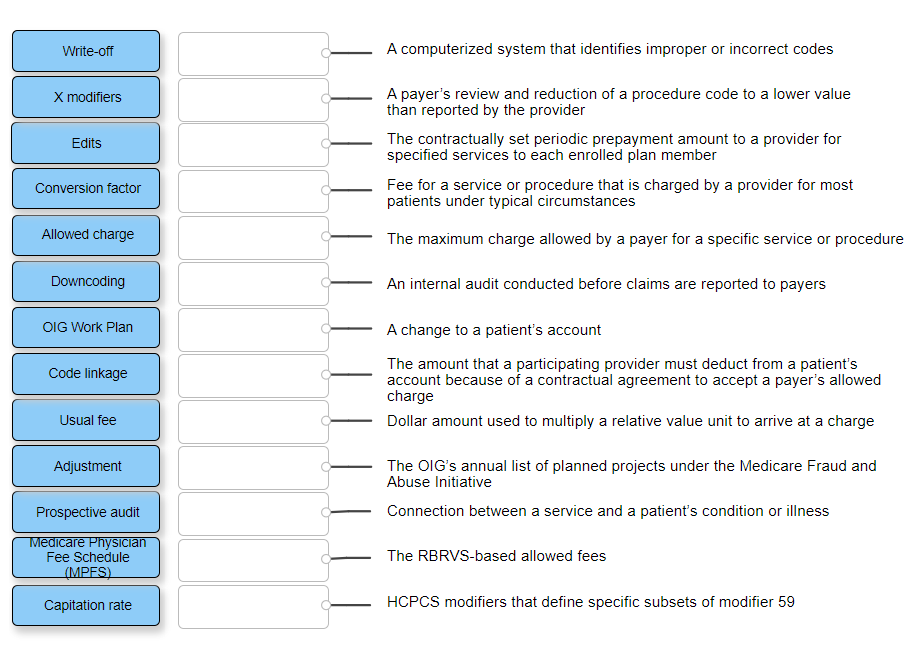

Question: Write-off A computerized system that identifies improper or incorrect codes X modifiers d Edits A payer's review and reduction of a procedure code to a

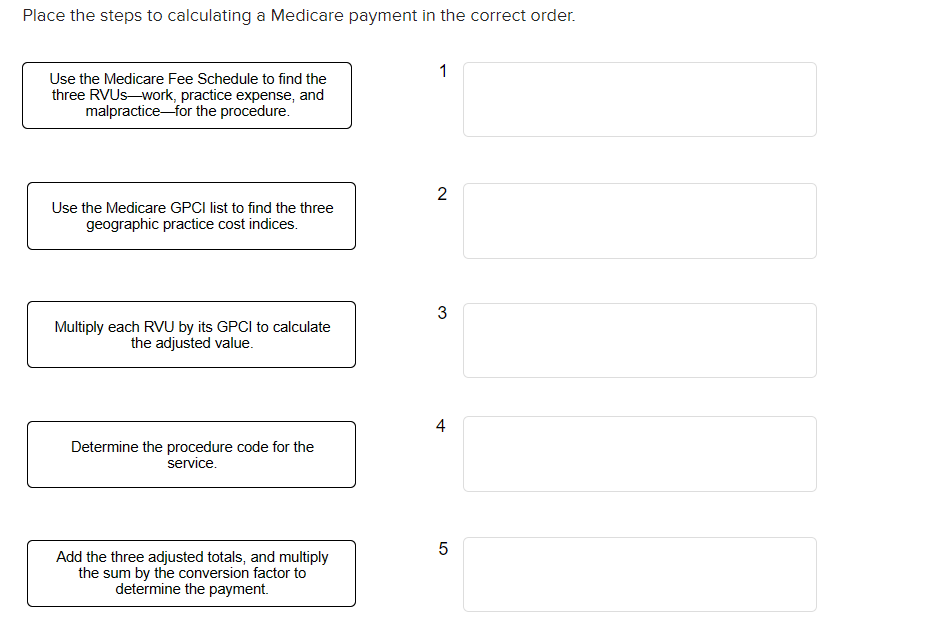

Write-off A computerized system that identifies improper or incorrect codes X modifiers d Edits A payer's review and reduction of a procedure code to a lower value than reported by the provider The contractually set periodic prepayment amount to a provider for specified services to each enrolled plan member Fee for a service or procedure that is charged by a provider for most patients under typical circumstances Conversion factor Allowed charge The maximum charge allowed by a payer for a specific service or procedure Downcoding An internal audit conducted before claims are reported to payers OIG Work Plan Code linkage A change to a patient's account The amount that a participating provider must deduct from a patient's account because of a contractual agreement to accept a payer's allowed charge Dollar amount used to multiply a relative value unit to arrive at a charge Usual fee Adjustment The OIG's annual list of planned projects under the Medicare Fraud and Abuse Initiative Connection between a service and a patient's condition or illness Prospective audit Medicare Physician Fee Schedule (MPFS) The RBRVS-based allowed fees Capitation rate HCPCS modifiers that define specific subsets of modifier 59 Place the steps to calculating a Medicare payment in the correct order. 1 Use the Medicare Fee Schedule to find the three RVUswork, practice expense, and malpracticefor the procedure. 2 Use the Medicare GPCI list to find the three geographic practice cost indices. 3 Multiply each RVU by its GPCI to calculate the adjusted value. 4 Determine the procedure code for the service. 5 Add the three adjusted totals, and multiply the sum by the conversion factor to determine the payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts