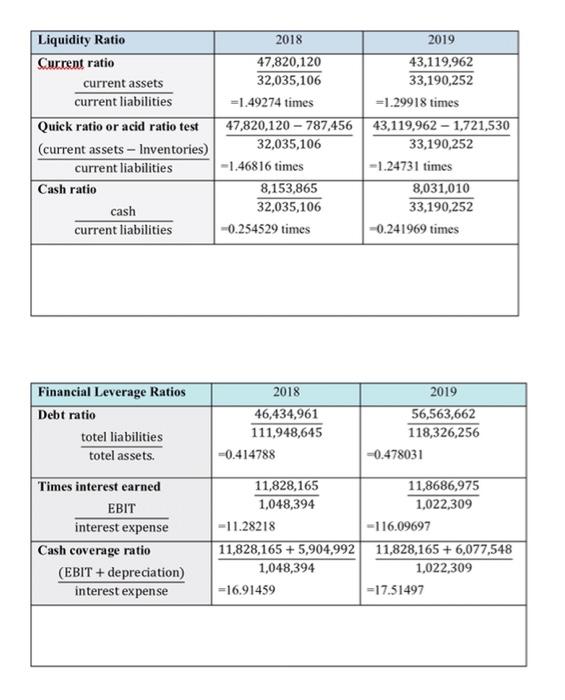

Question: - Writing a caption and analyzing the following tables in a linear fashion Note:company name is STC Liquidity Ratio Current ratio current assets current liabilities

Liquidity Ratio Current ratio current assets current liabilities Quick ratio or acid ratio test (current assets - Inventories) current liabilities Cash ratio 2018 2019 47.820,120 43,119,962 32,035,106 33,190,252 =1.49274 times =1.29918 times 47,820,120 - 787,456 43,119,962 - 1,721,530 32,035,106 33,190,252 -1.46816 times -1.24731 times 8,153,865 8,031,010 32,035,106 33,190,252 -0.254529 times -0.241969 times cash current liabilities Financial Leverage Ratios Debt ratio totel liabilities totel assets. 2018 46,434,961 111.948,645 -0.414788 2019 56,563,662 118,326,256 -0.478031 Times interest earned EBIT interest expense Cash coverage ratio (EBIT + depreciation) interest expense 11,828,165 11,8686,975 1,048,394 1,022,309 - 11.28218 -116.09697 11,828,165 + 5,904,992 11,828,165 + 6,077,548 1,048,394 1,022,309 =16.91459 -17.51497

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts