Question: WRITING EXERCISE 1. Sally Vertrees purchased a personal computer for use at home. Sally owns a dental practice. She occasionally uses the computer for a

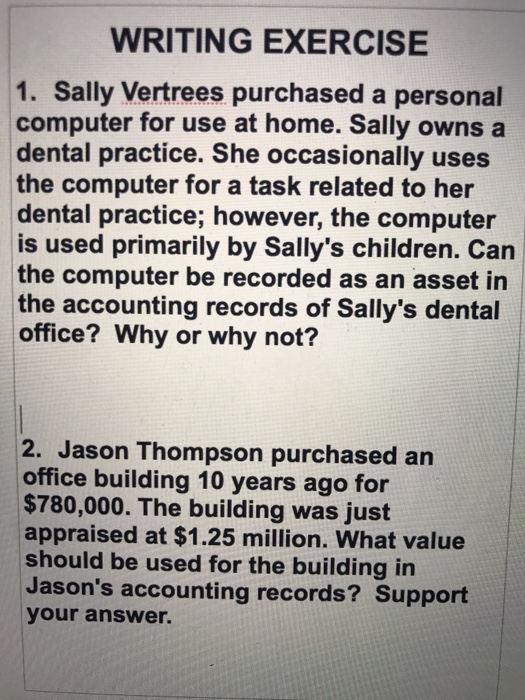

WRITING EXERCISE 1. Sally Vertrees purchased a personal computer for use at home. Sally owns a dental practice. She occasionally uses the computer for a task related to her dental practice; however, the computer is used primarily by Sally's children. Can the computer be recorded as an asset in the accounting records of Sally's dental office? Why or why not? 2. Jason Thompson purchased an office building 10 years ago for $780,000. The building was just appraised at $1.25 million. What value should be used for the building in Jason's accounting records? Support your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts